Traverse the article

In a world where remittance options are endless, how can providers truly stand out and keep customers coming back? Rapid globalisation and digital disruption have transformed the remittance landscape fuelling growth but also intensifying competition. Today’s customers expect more than speed and low fees! They seek relevance, rewards, and reasons to stay loyal. Promotions have become more than rewards! They are strategic tools to boost engagement and retention.

NetRemit addresses this challenge with its “Manage Promotions” feature, designed to help financial institutions implement targeted promotions, personalised offers, and loyalty programs. By leveraging AI-driven insights and automated campaign execution, NetRemit enables businesses to engage customers effectively, increase transaction frequency, and enhance overall satisfaction. With multi-channel integration, these promotions reach users across web platforms, mobile apps, and partner networks, ensuring a seamless and rewarding experience.

This blog explores the role of customer retention in the remittance market, key features of NetRemit’s Promotion Management, the benefits of loyalty programs, and the future of AI-led predictive promotions. Financial institutions, fintech professionals, and marketing teams will gain valuable insights into how strategic promotions can boost customer engagement and drive long-term success in the remittance industry.

The Role of Promotions and Offers in the Highly Competitive Remittance Industry

While pricing and speed are important, today’s remittance users are increasingly driven by value-added experiences. In an age of instant gratification and personalised digital services, customers expect more than just functional transactions! They seek recognition, rewards, and relevance.

How Targeted Promotions Drive Customer Loyalty and Transactions

Promotions and loyalty initiatives tap into this emotional economy, creating meaningful interactions that foster long-term trust. Service providers that understand and respond to these evolving expectations are better positioned to drive sustainable growth and deeper customer relationships.

- Personalised Offers: Targeted promotions based on user behaviour and transaction history improve engagement that includes first-time user incentives.

- Loyalty Programs: Rewards such as cashbacks, loyalty-based exchange rates, fee discounts through AI-driven dynamic pricing for frequent senders encourage long-term retention.

- Referral Incentives: Bonus rewards for inviting new users expand the customer base.

- Seasonal and Corridor-Based Discounts: Special promotions for peak seasons or specific corridors boost transaction volumes.

- Multi-Channel Campaigns: Promotions through email, mobile apps, and social media increase visibility and engagement.

Use Cases of Promotions in the Remittance Industry

Promotions are not just discounts! They are strategic tools to influence behaviour, drive growth, and boost engagement. Their real-time application is countless! From rewarding first-time users and reactivating dormant accounts to nudging preferred payment modes and retaining high-value customers. When aligned with business goals, promotions become a powerful lever to optimise the entire remittance journey.

Let us explore how they are applied in key areas of the remittance ecosystem.

- First-Time User Incentives: New customers receive a fee waiver or cashback on their first transaction, making it more attractive to try the service. This helps remittance providers acquire new users while building trust and engagement.

- Referral Programs: Existing users earn bonus rewards or discounts for referring new customers who complete a transaction. This cost-effective strategy drives organic growth and expands the customer base.

- Loyalty-Based Discounts: Frequent users unlock better exchange rates, reduced fees, or cashback based on their transaction history. This encourages repeat transactions and strengthens long-term customer relationships.

- Corridor-Specific Promotions: Providers reduce fees for specific remittance corridors with high transaction volumes, such as India, Mexico, or the Philippines. These targeted promotions help increase cross-border payments in key regions.

- Seasonal and Festive Promotions: Special discounts or bonus rewards are offered during major holidays and festive seasons. These campaigns align with peak remittance periods, boosting transaction volumes.

- Flash Deals and Limited-Time Offers: Time-sensitive promotions, such as “Zero-Fee Fridays” or weekend discounts, create urgency and drive immediate transactions. These short-term campaigns encourage users to send money more frequently.

- Subscription-Based Benefits: Customers who subscribe to a premium plan receive rewards like free transfers, priority processing, or better FX rates. This model enhances customer retention while providing consistent revenue for providers.

- Business and Payroll Transfers: Corporate clients and small businesses benefit from discounted FX rates and bulk transfer fee reductions. This helps businesses streamline international salary payments while saving on operational costs.

Key Features of NetRemit’s Promotion Management

NetRemit’s Promotion Management feature is designed to enhance customer engagement, increase transaction frequency, and improve retention. It provides a structured and automated approach to offering promotions, ensuring financial institutions can attract and retain users effectively.

- Promo Code Management: Enables discounts, cashback, and referral-based incentives to attract new users and retain existing customers. Customisable promo codes can be applied to specific transactions, user segments, or promotional periods.

- User-Based and Group-Based Personalisation: AI-driven personalisation delivers targeted promotions based on customer behaviour, transaction history, and engagement levels. Offers can be tailored for individuals or specific customer segments to maximise impact.

- Campaign Management: Automates the creation, execution, and tracking of promotional campaigns across multiple channels. Financial institutions can launch time-sensitive, event-triggered, or recurring promotions to drive engagement.

- Preferential Treatment for High-Value Users: Special discounts, loyalty rewards, and exclusive offers are provided to VIP users or high-frequency transactors. This reduces churn by ensuring valuable customers receive benefits that enhance their experience.

- Loyalty and Rewards Program: Encourages repeat transactions through tiered loyalty programs, cashback incentives, and milestone-based rewards. Users who send money frequently unlock better exchange rates, lower fees, or bonus credits.

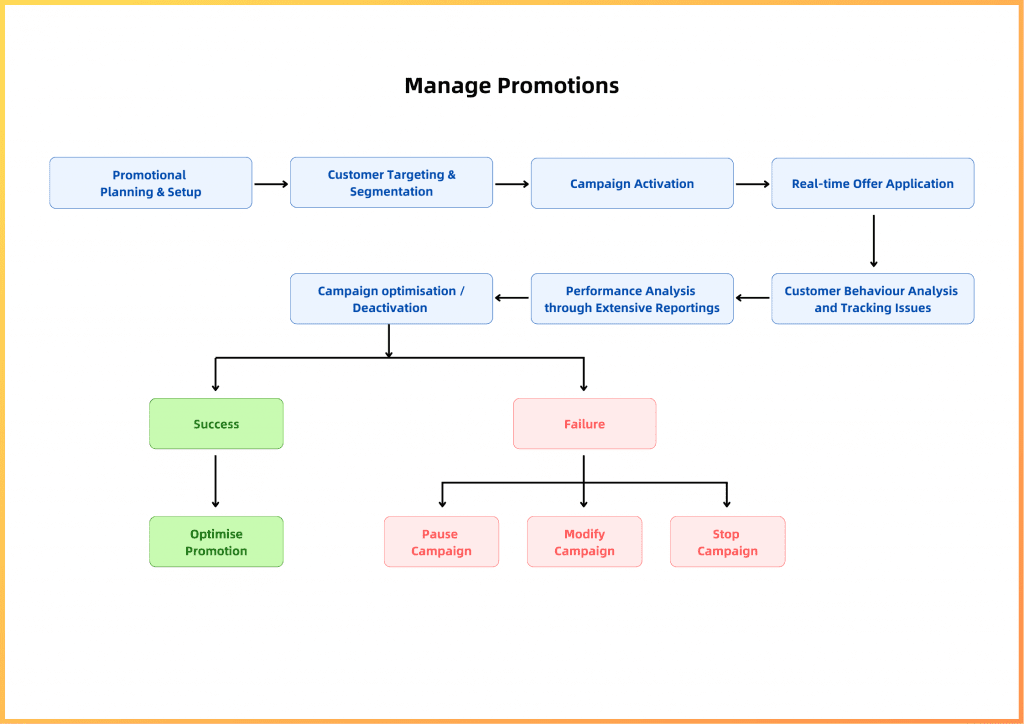

Technical Workflow Behind Promotion Management (Step-by-Step)

NetRemit’s Promotion Management feature is powered by a robust backend workflow that ensures seamless execution, accuracy, and personalisation.

Below is a high-level step-by-step breakdown of how the system works:

- Data Collection and Segmentation: The system begins by collecting data from various sources, such as user profiles, transaction history, behaviour patterns, and preferred corridors. Based on this data, users are segmented into meaningful groups (e.g. new users, high-frequency senders, corridor-specific users) to ensure personalised promotion targeting.

- Promo Code Validation: When a user applies a promo code, the system validates it against pre-defined campaign rules such as validity period, eligibility criteria, usage limits, and applicable transaction types. This ensures promotions are applied correctly, only to qualified users, and without misuse.

- Real-Time Eligibility Check: At the moment of transaction, a real-time validation engine checks if the user meets the promotion criteria (e.g. transaction value, user segment, geography). The system dynamically applies relevant discounts or cashback if all conditions are satisfied, improving user experience without delays.

- Integration with Payment System: The promotion engine is integrated with the payment and transaction processing system, ensuring that any discounts or incentives are applied instantly and reflected in the final payment summary. This tight integration ensures accuracy, compliance, and seamless execution across digital channels.

- Automated Tracking and Reporting: Post-transaction, all promotion-related data is captured for analysis. The system generates automated reports showing campaign performance, redemption rates, user participation, and financial impact. Advanced analytics provide insights into customer behaviour, preferred payment modes, sending frequency, and the effectiveness of different promotions. This helps refine future campaigns for better ROI.

How NetRemit is Impacting Remittance Through Loyalty Programs

NetRemit’s built-in loyalty program framework is designed to reward user behaviour, strengthen engagement, and encourage repeat usage. By aligning rewards with meaningful customer actions, NetRemit enables financial institutions to drive sustainable growth and improve customer satisfaction in a competitive remittance environment.

- Increased Customer Retention: Loyalty programs keep users engaged over time, encouraging them to return for repeat transactions instead of switching to competitors.

- Higher Transaction Volume: Users motivated by rewards and tier-based benefits tend to send money more frequently, resulting in consistent transaction growth.

- Improved Customer Satisfaction: Offering tangible benefits like cashback, fee waivers, or faster processing fosters a positive experience and greater user satisfaction.

- Boosted Brand Loyalty: Recognition through rewards and personalised incentives creates emotional connection with the brand, enhancing long-term loyalty.

- Referral Growth: Rewarding users for referring others fuels organic customer acquisition, expanding the platform’s reach with minimal marketing costs.

- Personalised Incentives: NetRemit leverages transaction data and behaviour analytics to tailor rewards to individual users or segments, making promotions more relevant and impactful.

- Competitive Advantage: A well-executed loyalty strategy helps financial institutions stand out in the crowded remittance space, attracting and retaining high-value customers.

Next-Gen Promotion Management: Powered by AI and Real-Time Data

The future of promotions in remittance is not just smarter — it is real-time, hyper-personalised, and context-aware. As AI, data analytics, and automation mature, promotion engines will evolve from simple campaign tools to sophisticated growth accelerators.

Here are the emerging capabilities driving this transformation:

- Hyper-Personalisation: Advanced algorithms will deliver highly individualised promotions based on transaction history, preferences, and user behaviour. With NetRemit, financial institutions can engage users more meaningfully, while end users receive promotions that truly match their needs and timing.

- Intelligent Customer Segmentation: Real-time segmentation based on behaviour, location, and transaction patterns enables ultra-targeted campaigns. NetRemit ensures institutions send the right message to the right customer, making users feel seen and valued.

- Context-Aware and Event-Triggered Campaigns: Offers triggered by birthdays, holidays, salary days, or cultural events to increase emotional connection. NetRemit makes every interaction feel personal, turning routine transactions into relationship-building moments.

- Geo-Targeted Offers Based on User Location: Location-specific incentives ensure offers are locally relevant and competitively positioned. Users feel catered to in their region, while institutions increase local market traction and customer loyalty.

- Gamified Loyalty and Reward Systems: Features like points, badges, and tiers make earning rewards fun and engaging. This makes users more active and loyal, while institutions benefit from increased usage and stronger brand connections.

- Integration with Third-Party Loyalty Ecosystems: Connect NetRemit rewards to external platforms (e.g., airline miles, e-commerce vouchers). Users enjoy added flexibility and value, while institutions expand their reward offerings without extra development.

- Real-Time Feedback Loops for Auto-Optimisation: Campaigns will auto-adjust based on user response data for peak effectiveness. Institutions save time and effort, while users consistently receive promotions that resonate with their preferences.

Wrapping Up

In an increasingly competitive remittance landscape, promotions and loyalty programs are no longer optional! They are strategic necessities. NetRemit, with its advanced features and orchestrated promotion engine, empowers financial institutions to drive deeper customer engagement, increase transaction volumes, and build long-term loyalty. With capabilities like promo code management, Intuitive personalisation, real-time validation, loyalty programs, and predictive insights, NetRemit empowers organisations to stay ahead of market trends and customer expectations. Financial institutions looking to enhance retention, build loyalty, and scale efficiently can leverage NetRemit’s robust platform to create lasting customer relationships. Ready to power your promotions and drive remittance success? Let NetRemit lead the way.

Loyalty and Growth in Your Remittance Business with Smart Promotions

Turn Offers into Growth with NetRemit

Ready to get started?

We can’t wait to show you what’s possible with NetRemit.

Related Posts

How Smaller Money Transfer Operators Can Thrive in International Remittance Landscape

Explore smart strategies and tech-driven solutions for small MTOs to establish leadership and dominate the competitive international remittance market.

Powering the Gig Economy with Instant Cross-Border Payments

See why instant cross-border payments are essential for the gig economy, eliminating delays, high fees, and inefficiencies while boosting global workforce efficiency.

Intelligent Payment Routing (IPR) – An Essential for P2P and B2B Remittance Businesses

Maximize efficiency in P2P and B2B remittance with Intelligent Payment Routing that ensures optimal transaction routing and settlement. Know how!