© 2025 Macro Global. All Rights Reserved.

Exploring E-wallets: Disrupting Traditional Payment Modes for International Money Transfer Ease

The prevalence of smart mobile phones has made digital wallets one of the most powerful financial instruments for both individuals and businesses. They offer a broad spectrum of digital-first features, worldwide reach, and instantaneous CBP processing, saving substantial money.

Their prominent features such as transparent transactions, competitive FX rates, and facilitation of contactless convenience, P2P payments, and loyalty management make it the favorite choice of many. As per a research, it is estimated that there will be over 5.2 billion digital wallet users in 2026 worldwide.

Challenges in Traditional Cross-border Payments

Traditionally, cross-border payments have encountered multiple challenges that hinder the transaction’s smoothness. Among the most significant obstacles encountered in the conventional payment environment are the following:

Lengthy Processing Times:

Several intermediaries are involved in cross-border payments, which has led to unnecessary delays. This is extremely concerning when urgent payments or receipts are required.High Transaction Fees:

Banks and financial institutions charge high transaction fees for processing payments across borders. These fees add up for business that conducts international transactions frequently.Currency Exchange Hassles:

The management of multiple currencies presents an immense challenge, as it necessitates detailed protocols and volatile exchange rates. This leads to unforeseen costs and makes financial management difficult.Lack of Security:

Traditional payment methods are susceptible to security breaches and fraud, exposing individuals and organisations to risk. Enhanced security is of primary concern in the digital age.

The Digital Wallet Solution

Digital wallets are offering a wide array of benefits that overcome the challenges faced by traditional cross-border methods.

Role of Digital Wallets in P2P Cross-Border Payments

Convenience and Accessibility

Digital wallets facilitate an efficient and intuitive payment process. With a few clicks, people may send and receive money across borders without all the hassle of traditional payment methods. These wallets are accessible through smartphones, making cross-border P2P payments easy.Efficiency and Rapidity

Cross-border payments using traditional methods are slow and complicated. Despite time and distance, digital wallets enable real-time transactions by utilising cutting-edge technologies, such as blockchain, to make the fund transfer quick and efficient.Reduced Costs

Cross-border payments often incur currency conversion and wire transfer fees. By substantially reducing transaction fees, digital wallets provide a more economical alternative. With competitive exchange rates and low fees, digital wallets can save users a great deal of money on P2P cross-border transactions.Streamlined Currency Exchange

Digital wallets ease currency trading with real-time conversion rates, multi-currency exchange, and fast conversions. The concern over volatile exchange rates and the challenges associated with managing multiple currencies has been addressed. Digital wallets simplify the procedure, letting you focus on business.Advanced Security

Digital wallets safeguard user data and funds with strong encryption and authentication protocols like two factor authentication, advanced encryption technique and biometric authentication. Users can improve security and privacy by conserving sensitive financial information for each transaction. Modern digital wallets offer insurance and fraud protection, enhancing user confidence in cross-border payments.

How B2B Cross Border Payments can Utilise Digital Wallets?

Enhanced Management of Cash Flow

Businesses can better manage cash flow with digital wallets. Organisations can ensure prompt payment of invoices to global partners and suppliers by utilising instant cross-border payment functionalities of digital wallet. Effective payment management improves working capital management and supplier relations.Global Market Expansion

Digital wallets enable cross-border transactions, helping businesses serve customers worldwide. By accepting foreign payments, firms can break into new markets and seize international opportunities. This expanded consumer base boosts corporate sales and revenue.Simplified International Payroll

Digital wallets optimise international payroll handling for multinational companies. By eliminating the complexities and expenses associated with traditional approaches, employers can effortlessly transfer salaries to employees spread across various countries. This cross-border payroll simplification boosts employee happiness and efficiency.Transparent and Traceable Transactions

Digital wallets afford organisations extensive transaction information, thereby facilitating visibility and accountability. This promotes greater control of financial records, making auditing and compliance easier. This function helps businesses comply with regulations, keep correct financial records, and show financial responsibility.

Types of Digital Wallets

Based on their accessibility and the type of functionalities they offer, Digital wallets are classified as follows:

Closed Wallets

Closed wallets, also known as closed-loop wallets, are built for particular purposes or inside a restricted ecosystem. Their usage is limited to transactions conducted exclusively on the platform or with affiliated merchants. A transaction cancellation or refund returns the full value to the wallet. Typically, only their specific network accepts closed wallets.

Semi-closed Wallets

More flexible than closed wallets yet limited. They are frequently employed for a multitude of purposes across a network of affiliated merchants, encompassing recharges, bill payments, and retail transactions. They can’t be utilised for transactions conducted outside of this network, though.

Open Wallets

The most versatile and universally recognised digital payment systems are open wallets, also known as open loop wallets. They are suitable for transactions with both merchants and service providers and are not limited to a particular network. The sender and receiver must use the same app to access an open wallet worldwide.

Cryptocurrency Wallet

Cryptocurrency wallet is meant for storing, transmitting, and receiving cryptocurrency, by utilising public and private keys in a digital setting. It is an essential component of both cryptocurrency transactions:

- On-ramp (converting fiat currency to cyrptocurrency) and

- Off-ramp (swapping cryptocurrency for fiat currency).

In general, custodial (managed by centralised exchanges) and non-custodial (handle their own private keys, gaining more autonomy and security) are the two most common kinds. For individuals who value privacy and independence, non-custodial wallets are a must-have.

Single Currency Wallet VS Multi-Currency Wallet

| Specification | Single Currency Wallet | Multi-Currency Wallet |

|---|---|---|

| Currencies Supported | One Currency such as EUR, USD, GBP. | Supports fiat currencies (EUR, USD,etc), cryptocurrencies (Bitcoin, Ethereum), stablecoins (DAI, USDC), and non-fungible tokens (NFTs) (digital art, collectibles). |

| Transactions | Limited to transactions in the supported currency. | Can store, send, receive, exchange multiple currencies & digital assets in unified platform. |

| Ease of use | Simpler to use, especially when dealing with single currency. | More convenient for travellers and those who deal with multiple currencies regularly. |

| Ideal for | Individuals/businesses that deal with one currency. | Travelers, businesses that deal with many countries, individuals who receive income in multiple currencies. |

| Security | Offer the same level of security as a traditional bank account. | Offer additional security features for managing multiple currencies. |

| Special Mention | Fewer features and functions simplify navigation of the wallet. |

|

| Currencies Supported | |

|---|---|

| Single Currency Wallet | One Currency such as EUR, USD, GBP. |

| Multi-Currency Wallet | Supports fiat currencies (EUR, USD,etc), cryptocurrencies (Bitcoin, Ethereum), stablecoins (DAI, USDC), and non-fungible tokens (NFTs) (digital art, collectibles). |

| Transactions | |

| Single Currency Wallet | Limited to transactions in the supported currency. |

| Multi-Currency Wallet | Can store, send, receive, exchange multiple currencies & digital assets in unified platform. |

| Ease of use | |

| Single Currency Wallet | Simpler to use, especially when dealing with single currency. |

| Multi-Currency Wallet | More convenient for travellers and those who deal with multiple currencies regularly. |

| Ideal for | |

| Single Currency Wallet | Individuals/businesses that deal with one currency. |

| Multi-Currency Wallet | Travelers, businesses that deal with many countries, individuals who receive income in multiple currencies. |

| Security | |

| Single Currency Wallet | Offer the same level of security as a traditional bank account. |

| Multi-Currency Wallet | Offer additional security features for managing multiple currencies. |

| Special Mention | |

| Single Currency Wallet | Fewer features and functions simplify navigation of the wallet. |

| Multi-Currency Wallet |

|

Future of Digital Wallets

Digital wallets are becoming comprehensive financial hubs, integrating budgeting apps, investment platforms, and insurance products. Emerging trends like biometric authentication offer enhanced security, while AI-powered assistants personalize financial experiences.

Open banking initiatives and interoperability across providers create a frictionless financial ecosystem, breaking down siloed data and enabling seamless transactions. Parallel to this, Blockchain technology can fundamentally transform digital wallets in terms of trust and transparency.

Digital wallets assist the unbanked and underbanked, promoting financial inclusion and giving people more control over their finances. A cashless future propelled by digital wallets offers small businesses an opportunity for expansion, enhanced efficiency, and environmental advantages.

The future of digital wallets offers a more accessible, inclusive, and empowered financial world by embracing innovative technology and emphasising ethical standards.

NetRemit offers a sophisticated integration with digital wallets to offer secure, hassle-free, and speedy cross-border payments. Through our UTS program, we help you to maximise your business potential by integrating digital wallets to collect payments and settle payments to the beneficiaries’ digital wallets. If you are an established remittance service provider or a new entrant who is looking to embrace digital transformation and gain value, feel free to schedule a discussion with our subject matter experts.

Ready to get started?

We can’t wait to show you what’s possible with NetRemit.

Unlocking Opportunities: Fintechs & MTOs Bidding on Low Value Cross Border Payments

Low-value cross-border payments refer to the monetary transactions involving relatively modest amounts sent across national borders. These transfers are usually made by migrants or individuals sending money to friends and family in their homeland. As the name implies, these transactions are worth a few dollars to a few hundred dollars. It is projected that by 2026, this segment—which includes micropayments, remittances, and P2P transfers—will be worth up to $5 trillion.

Challenges in Traditional Banks

The following are the challenges faced by traditional financial institutions in managing Low-value cross-border payments (CBP)

High Costs:

Traditional banks frequently charge high fees and exchange rates for low value cross-border payments, rendering it uneconomical for individuals and small businesses.

Complex CBP System & Lengthy Transaction Times:

As the traditional banks involve several intermediaries in the fund transfer process, it can slow fund transfers and lead to errors, especially for low-value payments.

Lack of Transparency:

Traditional banks may not disclose costs, currency exchange rates, or transaction timelines, leaving payers and payee uncertain about the charges.

Accessibility and Inclusion:

Individuals and small businesses in developing economies find it difficult to access the cross-border payment operation of traditional banks owing to its costly and lengthy procedures.

Opportunities for Fintechs & MTOs

In 2020, consumer payments hit $2.1tn and are predicted to climb 6% annually. Consumer-to-business transfers, which are mainly linked with global transactions, constitute an impressive opportunity for many players such as MTOs and fintechs, amounting to $1.4 billion and are extremely important for the growth of emerging economies. Notably, many developing countries lack access to standard banking services and financial inclusion remains a challenge. Therefore, the role of banks in ensuring the security and accountability of cross-border payments cannot be overstated.

In the present scenario, technological advances are making low-value payments faster, affordable, and more transparent. For low-value cross-border payments, the international financial community must collaborate to improve present solutions and develop new ones. It is vital that we take this step towards a more inclusive global economy by addressing the challenges associated with executing these payments globally.

How MTOs and Fintech Can Address these Unbanked Customers for Low-Value Cross-Border Payments

Simplifying KYC/CDD

Risk-based approaches:

Analyse transaction patterns, device information, and alternative data to assess risk levels and implement lighter verification for low-value transactions.Mobile phone verification:

Utilise mobile phone numbers as a primary identification method, especially in regions with limited documentation.Biometric authentication:

Adopt technologies like fingerprint and facial recognition for secure and convenient identity verification.

Prioritise Speed & Affordability

Simplified onboarding:

Digital account opening and KYC verification with minimal documents.Competitive transaction fees:

Charge lower fees for money transfers, and other financial services than traditional banks and money lenders.Real-time transactions:

Offering instant fund transfers and access to financial services through mobile apps and platforms.Offline functionality:

Utilising agent networks and USSD-based platforms (Unstructured Supplementary Service Data) to guarantee service accessibility in regions with limited internet connectivity.

Cut Out the Intermediaries

Removing unnecessary players from transactions empowers direct engagement between parties. Employing blockchain and other innovative technologies can optimise transaction flow, eliminating the layers that inflate fees and slow down the process. Eliminating the intermediaries unlocks a world of faster, cheaper, and more inclusive transactions.

Leveraging Mobile and Digital Technologies

Fintech companies are developing user-friendly platforms that facilitate the transfer of small payments across international borders by utilising mobile and digital technologies. This eliminates laborious documentation, hidden charges, and lengthy waiting times.

Flexible Payment Methods

With emerging technologies, fintech can offer a range of options to customers to choose the desired payment method. Be it through mobile wallets, bank transfers, linking debit cards, or even cash-in/cash-out networks.

Transparency

Fintechs may inform the client of the fees and FX charges associated with each international money transfer prior to its execution.

Role of FinTechs in Low-value Cross-Border Payments

Leveraging the Power of Partnerships

Access to Global Payment Networks:

Fintechs can access vast global payment networks by partnering with SWIFT GO, Ripple Net. This allows them to reach a wider audience, deliver instant transactions, and offer competitive rates. This breaks down geographical barriers, making cross-border payments smooth, efficient, and convenient.Bill Payments:

Fintechs are partnering with bill payment platforms to bridge the gap for the unbanked by offering seamless integration, accessibility for all, and transparent payments. This enables people to pay for essentials like utilities, rent, or family support from their mobile phones, promoting financial inclusion and empowering unbanked communities.Local Agents & Retailers:

Local agents and retailers are partnering with fintechs to offer cash-in/cash-out options for those without digital infrastructure or bank accounts. This allows them to reach remote areas and underserved communities, while also providing flexibility and trust. Also, these partnerships bridge the gap between digital innovation and traditional preferences.

Diverse Payment Tools

Swift GO:

Swift GO is an innovative service that enhances low-value cross-border transactions through the provision of a solution that is quick, predictable, secure, and priced competitively. It empowers financial institutions to offer SMBs and individuals sending money internationally a streamlined payment experience. Swift GO also offers transparency on processing fees, allowing real-time tracking of payment status. It streamlines user experience, minimises delays, and reduces processing costs, underpinning payments with the SWIFT network’s robust security.Digital Wallets:

Digital wallets are like carrying your bank in your pocket, as they offer a secure, user-friendly platform for unbanked individuals to manage their finances. They store funds safely, facilitate easy money transfers, and provide transaction records and budgeting tools, promoting financial literacy and responsible money management.Pre-paid Cards:

Prepaid cards help customers make payments without a bank account, minimum balance, or credit check. Positive credit history with prepaid cards aids in getting finance in the future. Also, through the pre-loading of a specified sum of money into the pre-paid card, adherence to the budget is ensured and reckless spending is prevented.

How NetRemit Promotes Low-Value Cross-border Payments?

NetRemit caters to the specific needs of MTOs and Fintech companies dealing with low-value cross-border payments by following means:

White-Label Solutions: Your Brand, Your Way

Branding control:

Maintain your brand identity while leveraging NetRemit’s technology.Flexibility and customisation:

Customise your platform that easily adapts to your specific requirements and preferences.Faster market entry:

Can quickly launch your cross-border payment services, as the development time is minimal.

Remittance Technology as a Service (RTaaS): Seamless CBP

Seamless Integration:

Easily integrates into your thrid party platforms for AML/KYC, foreign exchange, payment gateway, payouts and manages all the back-end activities of cross-border payments.

Reduced Costs:

No need to build and maintain remittance infrastructure and hence there are significant cost savings.

Scalability:

Designed to handle both low and high transaction volumes, allowing you to easily scale the business based on growth.

Real-time Transaction: Speed that Impresses

Instant Transactions:

Provide immediate gratification for your users, enhancing satisfaction.Competitive Edge:

Offer faster transaction speeds compared to traditional methods.Improved User Experience:

Streamline the payment process for a smoother user journey.Diverse Payment Options:

Stand to serve various user preferences with multiple payout methods.Streamlined Operations:

Manage all your cross-border payment needs through a single platform.

NetRemit’s value proposition extends beyond technology as they actively collaborate with FIs to ensure their success in the low-value cross-border payment market.

Thus, NetRemit offers a comprehensive solution for MTOs and Fintech companies to serve the unbanked and underbanked populations efficiently and effectively with fast, reliable, and convenient white-label international remittance software.

Ready to get started?

We can’t wait to show you what’s possible with NetRemit.

Anti-Money Laundering (AML) & Money Services Businesses (MSBs) –

The term “money service business” is used to describe various financial activities conducted as a business. These activities include acting as a currency exchange office, transmitting money or any representation of money, and cashing cheques on behalf of customers. Their role extends beyond mere transactions as they support a wide range of business transactions and bridge gaps in financial access.

Cross-border payments act as an avenue for growth of MSBs, as they enable customer expansion and the diversification of their revenue streams. However, navigating the complex regulations and handling the risks associated with cross-border transactions is challenging.

MSBs can maximise their performance by adopting secure technologies, building connections with financial institutions, and staying aware of regulatory trends.

Latest Trends in AML Compliance

Increased Regulatory Rigidity

Stringent requirements for AML compliance are being imposed by regulatory authorities across globe. With more regulations and norms, financial institutions need strong AML frameworks in cross-border operations.

Technical Developments

Technological advancements including generative AI, machine learning and blockchain are expanding progressively to reinforce anti-money laundering (AML) initiatives. These tools ease compliance and improve the detection of real-time suspicious activities.

Information Sharing and Collaboration

There is an emerging pattern of international cooperation between regulatory bodies and financial institutions. By exchanging AML intelligence and best practices, an effective security against money laundering activities can be built.

Enhanced Customer Due Diligence

The transition towards a proactive and risk-based approach is the core of Enhanced CDD that is altering the traditional approach to CDD. This enhanced due diligence procedures have become a standard practice, notably in the case of high-risk cross-border transactions.

As MSBs have become prime targets for money laundering activities, comprehensive AML guidance is required to ensure their robust compliance.

USA

MSBs must register with FinCEN and are governed by the Banking Secrecy Act in the United States. MSBs need to renew it every two years. Additionally, in several regions, they are required to register with the jurisdiction in which they conduct business. They have to establish strong AML programmes including:

- KYC

- Suspicious Activity Reporting

- Promptly exposing any transactions over $10,000 in a single day.

UAE

To ensure the AML compliance of MSBs, UAE has enacted a set of regulations. They have emphasised the following in the guidance:

- Maintaining records

- Modeling risk-based approaches

- Reporting suspicious transactions

- Customer Due Diligence

- Additionally, MSBs are subject to licencing in the UAE to assure adequate supervision.

UK

The FCA enforces the Anti-Money Laundering (AML) regulations for MSBs in the UK. Key anti-money-laundering (AML) procedures followed in UK involve

- Registration with HMRC

- Performing customer due diligence (CDD) on both new and existing customers

- Reporting suspicious activity to the NCA

- Preserving transaction records for a time frame of five years

- Providing training for staff on AML procedures.

These procedures prevent criminals from laundering money through MSB.

Germany

In Germany, MSBs are subjected to the following guidance:- Register with BaFin (Federal Financial Supervisory Authority)

- Fulfil reporting requirements

- Keep meticulous records

- Adhere to the Fourth Money Laundering Prevention Act

The most important aspects cover internal controls, transaction monitoring, and customer due diligence. Together, these guidelines and BaFin’s active supervision ensure a robust AML framework for MSBs in Germany, thereby safeguarding the integrity of the financial system.

France

MSBs at France must adhere to strict AML regulations, outlined by the ACPR. It requires:- Maintenance of records

- Internal control

- CDD

- Filing of SARs to Tracfin, the national financial intelligence unit, for transactions exceeding €10,000 or raising red flags

- Employee Training

Italy

MSBs need to comply with strict Anti-Money Laundering (AML) regulations framed by the Unità di Informazione Finanziaria (UIF) in Italy. These guidelines aim to combat financial crime by requiring:- Identification checks for transactions exceeding €1,000

- Transaction monitoring with automated systems

- Establishing and documenting internal AML policies and procedures

- Filing suspicious activity reporting within 30 days

- Maintaining detailed records of transactions, including client information, nature of transactions, and source of funds, for at least five years.

Switzerland

In Switzerland, the Federal Act on Money Laundering (AMLA) have designed the framework for AML regulations that mandate:

- Risk assessments

- Know Your Customer (KYC) procedures

- Ongoing transaction monitoring

- SAR.

Swiss Financial Market Supervisory Authority (FINMA) further put forth detailed guidelines such as

- CDD

- Identification verification

- Record-keeping

- Internal control systems

Besides, the requirements are specific for several types of MSBs, like foreign exchange bureaus and remittance providers.

Netherlands

The Dutch Ministry of Finance and De Nederlandsche Bank have laid groundwork for AML guidelines for MSBs to implement a robust AML/CFT program to prevent misuse of services for illegal activities.Saudi Arabia

Saudi Arabian Monetary Authority (SAMA) regulates and supervises AML guidelines in KSA . According to SAMA, MSBs must:- Register with SAMA

- Comply with FATF recommendations

- Establish effective AML practices.

Regulatory, Compliance Aspects and Frameworks Governing AML For MSBs

-

Financial Action Task Force (FATF)

The Financial Action Task Force (FATF) is a policy-making body that set global standards for financial institutions to promote effective legal, regulatory, and operational measures and combat money laundering and terrorist financing threats. -

The Financial Transactions and Reports Analysis Centre of Canada

FINTRAC is Canada’s financial intelligence unit and supervisor for anti-money laundering and anti-terrorist financing, focusing on detecting, preventing, and deterring such activities. -

The Financial Crimes Enforcement Network

FinCEN is a bureau of the United States Department of Treasury tasked with the prevention of money laundering, terrorism financing, and financial offences in partnership with financial institutions and law enforcement agencies. Financial Conduct Authority

In the United Kingdom, the FCA is a regulatory body charged with safeguarding the integrity of the financial markets. This principal regulator of the banking, insurance, and investment industries protects consumers, maintains market order, and promotes financial stability in the UK. It regulates financial firms to ensure ethics and transparency and protection from money laundering.Wolfsberg Group AML Principles for Correspondent Banking

The Wolfsberg Group is a consortium of notable financial institutions that has established standards for correspondent banking that comply with anti-money laundering (AML) regulations to enhance the AML compliance of financial institutions.The EU Anti-Money Laundering Directives (AMLDs)

The European Parliament releases the EU AMLDs at regular intervals, which Member States need to implement into their domestic legislation. Member-state governments must follow new rules added or updated in every directive. The AMLD mandates that designated professionals and financial institutions adopt necessary anti-money laundering measures in all EU member states.

Effective Components of AML Guidance

Risk Assessment:

A strong framework that includes an in-depth analysis of MSB’s customers, products, services, and locations is essential to find out the risks they typically face. Risk assessment helps MSBs adopt risk-specific controls.Monitoring of Transactions:

A critical element of AML guidance for MSBs is transaction monitoring. Its objective is to detect any suspicious or fraudulent activities through the continuous and methodical examination of consumer transactions. Advanced technology and analytical techniques can detect anomalous patterns, significant cash transactions, structuring, and other red flags that could indicate money laundering or terrorist financing in transaction monitoring systems.Record-Keeping:

MSBs are bound to maintain complete and exact records of their financial transactions. This entails transaction details, consumer identification information, and supporting documentation. Good record-keeping helps MSBs comply with AML requirements while providing critical information to regulatory authorities during investigations.Fraud Detection:

To identify potential financial crimes, MSBs must implement efficient fraud detection mechanisms along with AML measures. This requires using advanced technologies such as artificial intelligence and data analytics to detect identity theft, forgery, and account takeover attempts.Currency Transaction Report (CTR) and Filing Automation:

When substantial cash transactions surpass predetermined levels, MSBs must file CTRs). It is recommended for MSBs to carry out CTR filing automation to enhance accuracy, efficiency, and compliance.Know Your Customer (KYC) Verification:

MSBs should have efficient KYC processes to authenticate customer identities and comprehend financial transactions. MSBs can analyse client risks and uncover illicit activity by using reliable customer identification and verification methods.Biometric Authentication:

Leveraging biometric authentication into customer identification and verification procedures can significantly improve security and precision. MSBs can dramatically reduce identity theft and impersonation by using biometrics like fingerprints or facial recognition.E-Signature Authentication:

MSBs can securely obtain customer consent, validate transactions, and maintain dependable electronic records through e-signature authentication. MSBs can improve transaction security and prevent fraud by using e-signature authentication. However, e-signatures must meet legal and regulatory criteria.Reporting:

The MSB must report suspicious transactions to the relevant regulatory authorities. Reporting helps law enforcement discover suspicious activity and investigate. MSBs must streamline reporting to work with regulators to fight financial crimes.

Role of Advanced Technologies in Promoting AML Compliance

Automation

Automation plays a key role in AML guidance for MSBs as it helps in transaction monitoring by identifying unusual financial transactions via data analysis and Know Your Customer (KYC) procedures by utilising digital identification systems to minimise identity fraud.

Advanced Analytics

Advanced analytics aids in identifying potential money laundering activities in financial transactions through pattern recognition and machine learning algorithms. It also enables a risk-based approach, creating risk profiles for customers, allowing effective risk assessment and categorisation, ensuring that MSBs focus their AML resources on high-risk customers or transactions.

Artificial Intelligence

Generative AI can identify hidden patterns, forecast future trends in financial transactions, and analyse complex data sets in MSBs by mimicking humans. Therefore, MSBs can improve their AML compliance efforts, build effective risk models, and detect suspicious activities.

Blockchain

Blockchain technology’s decentralised structure and inherent transparency potentially augment the level of AML compliance observed by MSBs and help them to safeguard and tamper-proof financial transactions. Blockchain technology aid MSBs in ensuring customer legitimacy and enforcing AML regulations by utilising smart contracts and digital identity verification.

Future Outlook

The evolution of AML guidance for Money Service Businesses (MSBs) is likely to be driven by technological advancements, heightened scrutiny, shifting risks, and collaborative efforts. More stringent laws will be implemented to combat money laundering and international collaboration and information exchange will be promoted to raise global compliance standards.

The regulatory focus will shift customising MSB’s AML modules according to the risk profile of the organisation. Generative-AI and machine learning will promote the automation of KYC/CDD processes, identification of suspicious activity, and prediction of money laundering trends. The blockchain technology will improve traceability of transactions, helping with AML compliance.

The emerging money laundering trends such as Crypto-laundering and synthetic identity fraud will demand the development of unique measures to detect and mitigate money laundering. MSBs will need to strike a balance between compliance and customer experience to remain competitive and fight against money laundering.

Macro Global’s NetRemit: Key to Enhanced AML Compliance

Macro Global’s NetRemit partners with premier KYC, AML, and fraud protection vendors to simplify MSB AML compliance. This enables MSBs to leverage top-notch technology and expertise without managing many vendors or establishing their own compliance infrastructure.

- By integrating with efficient KYC/CDD providers, NetRemit enables expedited and secure customer verification via facial recognition, identity document checks, and other innovative techniques.

- NetRemit supports MSBs in identifying and preventing money laundering attempts by collaborating with fraud prevention experts to consistently track transactions for suspicious behaviour.

- With NetRemit, you can have confidence that Suspicious Activity Reports (SARs) will be generated and filed with respective regulatory authorities on time, helping you stay compliant without incurring penalties.

- By configuring risk-based rules and limitations, MSBs can customise their AML compliance programmes with NetRemit to suit their unique requirements and risk profiles.

Macro Global’s NetRemit assists MSBs to maintain a competitive edge in the dynamic AML ecosystem and concentrate on their business, delivering prompt, dependable, and secure remittance services to their customers across borders.

Ready to get started?

We can’t wait to show you what’s possible with NetRemit.

Reinventing Cross Border Payments Business with (RTaaS)

Amidst the challenges vested upon managing diverse regulatory landscapes, fragmented corridor infrastructures, and evolving user expectations, challenges that even the most advanced financial institutions face. Legacy systems, with their operational limitations, are no longer relevant in today’s fast-paced, real-time economy.

Institutions that fail to scale are facing severe backlash, unable to thrive in the fast-paced, competitive landscape. They are also forced to recalibrate business agility with control, responding to regulatory shifts while delivering seamless, scalable payment experiences.

While they look to scale their institution’s performance, it is essential to look for the right partners, appropriate solutions, and mainly compatible with the operations of the parent firm and comply with international regulatory bodies. It is not just a strategic move, but a futuristic shift towards development.

Challenges in International Remittance

Despite the burgeoning growth, international money transfer still suffer from complex domains in financial services, where every corridor introduces a new layer of regulatory, operational, and technological nuance. Despite the proliferation of digital rails and fintech innovation, institutions continue to face fundamental limitations that prevent scale, compliance agility, and real-time delivery.

Let us analyse the challenges in detail:

- Systemic Rigidity of Legacy Infrastructure: Most remittance operations are still anchored in core banking systems designed for batch processing, not real-time settlement. These systems are typically inflexible, making it difficult to adapt to fast-evolving partner APIs, FX logic, or settlement schemas. As corridors diversify and digital wallets rise, legacy infrastructure becomes a bottleneck.

- Fragmented Regulatory Landscapes: Each jurisdiction imposes its compliance stack, ranging from FATF-aligned AML rules to region-specific data localisation mandates. Managing these in-house often leads to brittle, hardcoded rules across disparate systems. Without embedded compliance orchestration, institutions struggle to maintain audit readiness across corridors.

- Latency in Corridor Activation: Expanding into new geographies requires corridor-specific integrations, testing routines, and settlement configurations. The absence of pre-integrated corridor logic forces institutions to engage in multi-month buildouts, delaying speed-to-market and draining internal bandwidth.

- Operational Drag from Manual Interventions: Many institutions rely on semi-automated workflows for onboarding, screening, reconciliation, and exception handling. These manual dependencies increase reconciliation lag, reduce transaction throughput, and introduce regulatory risk, especially in high-volume corridors.

- High Total Cost of Ownership: Owning and maintaining a proprietary remittance stack entails significant upfront capex, compliance engines, corridor integrations, UI/UX layers, and FX infrastructure, all of which require ongoing updates. Moreover, every market expansion reintroduces the same cycle of costs, testing, and resourcing.

- Limited Real-Time Visibility and Control: Legacy systems rarely provide unified, real-time dashboards across corridors, partners, and compliance checkpoints. This lack of observability impairs SLA enforcement, FX tracking, and fraud response, while making it difficult for operations and risk teams to intervene proactively.

How NetRemit RTaaS Addresses the Structural Challenges of Remittance

NetRemit’s approach of Remittance Technology as a Service (RTaaS) is a modular, compliance-embedded, and corridor-ready framework designed to meet the demands of a dynamic CBP environment. With an edge in the industry, it goes beyond streamlined operations.

Here’s how it systematically addresses the structural challenges faced by CBP institutions:

- Modular, API-Driven Architecture Replaces Rigid Legacy Systems: Built on a cloud-native, microservices architecture that decouples remittance functions from core banking systems. Each module can be deployed, scaled, or replaced independently through secure APIs. This enables institutions to respond to corridor-specific demands or partner integrations without rewriting core logic.

- Embedded Compliance by Design: It incorporates jurisdiction-specific compliance protocols directly into the transaction flow. It also has real-time KYC/AML screening, sanction checks, and transaction monitoring built into the orchestration layer. The platform adheres to FATF, GDPR, PSD2, PRA, and other regulatory standards from day one, enabling audit-readiness across geographies.

- Pre-Integrated Global Corridors with Smart Routing: This platform is fortified with out-of-the-box connectivity to a wide network of corridors, payout partners, and wallet systems. Its Universal Transaction Switch intelligently routes transactions based on SLA targets, FX rates, and partner availability, ensuring speed, redundancy, and cost-efficiency.

- Intelligent Automation Reduces Operational Drag: Manual interventions are minimised through rule-based automation and workflow engines. From onboarding to reconciliation, the platform uses efficient configuration and intelligent exception handling to eliminate delays and improve throughput. This automation frees up compliance and operations teams to focus on exceptions and strategic tasks rather than routine interventions.

- Elastic Scalability with Low TCO: The platform follows a subscription-based, pay-as-you-scale model, removing the need for upfront infrastructure investment. Its elastic compute model ensures performance regardless of volume spikes, while reducing the operational overhead and maintenance burdens common with in-house systems.

- Real-Time Visibility and Control Across the Stack: Equipped with live dashboards for corridor performance, FX exposure, SLA tracking, and compliance flags. Role-based access control, maker-checker flows, and automated alerts give institutions the observability and control required for proactive governance and operational integrity.

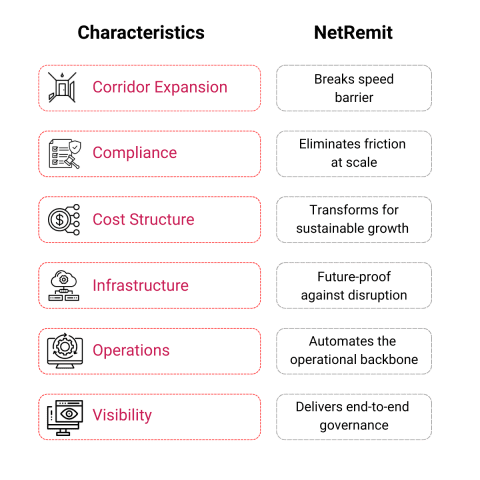

Why NetRemit’s Remittance Technology as a Service is a Game-Changer for Remittance Institutions

NetRemit, driven by forward-looking design, transforms international money remittance from a legacy constraint into a competitive advantage. By addressing deep-rooted operational and compliance challenges, it empowers institutions to scale faster, adapt smarter, and lead confidently in a real-time economy.

Here are the advantages:

- Breaks the Speed Barrier in Corridor Expansion: Traditional corridor onboarding is slow, manual, and resource intensive. NetRemit removes these barriers with multi-corridor interfaces, pre-integrated payout rails and modular APIs, allowing institutions to enter new markets in days, not quarters.

- Eliminates Compliance Friction at Scale: Fragmented compliance stacks are a major source of delay and risk. NetRemit embeds real-time KYC/AML, sanction screening, and data-localisation checks through third-party partners directly into transaction workflows, removing the burden of constant updates and audits.

- Transforms Cost Structure for Sustainable Growth: Moving from capex-heavy infrastructure to a scalable, pay-as-you-grow model dramatically reduces the total cost of ownership. With NetRemit, institutions no longer have to choose between cost control and innovation. Operational efficiency and growth can now go hand in hand.

- Future-Proof Infrastructure Against Industry Disruption: As payment systems evolve real-time rails, CBDCs, AI-driven compliance—NetRemit’s composable, cloud-native architecture ensures institutions can integrate and adapt without reengineering their core. It’s not just about keeping up with change—it’s about being ready to lead it.

- Automates the Operational Backbone: Manual processes in reconciliation, validation, and partner routing create bottlenecks and risk. NetRemit replaces these with intelligent, rule-based automation that improves speed, accuracy, and scale. This shift frees up talent to focus on higher-value initiatives.

- Delivers End-to-End Visibility and Governance: Fragmented views and data silos are no longer acceptable. NetRemit’s live dashboards and audit-ready reporting provide a unified view across transactions, partners, and corridors—empowering compliance, operations, and strategy teams to act on real-time intelligence.

NetRemit RTaaS is not just a solution to current pain points! It’s an enabler of what’s next. It equips CBP institutions to operate with agility, scale with confidence, and innovate without compromise. In a market where speed, compliance, and experience define success, NetRemit turns cross-border payments from a legacy liability into a future-proof asset.

Tailored RTaaS Use Cases for Banks, MTOs, and FX Providers

As the remittance landscape rapidly evolves, financial institutions of all sizes and specialties, whether traditional banks, emerging MTOs, or FX providers require tailored solutions to remain agile, compliant, and competitive. NetRemit’s RTaaS model extends beyond technology, offering an ecosystem of strategic services that align with real-world business goals across varied segments.

Here’s how NetRemit’s Remittance Technology as a Service delivers targeted value across key institution types:

Retail and Challenger Banks: Digitising and Scaling Remittance Services

Challenge: Legacy systems and fragmented corridor partnerships prevent banks from launching modern, scalable remittance services.

Remittance Technology as a Service (RTaaS) in Action:

- Go-to-Market Consulting simplifies the complexities of MSB licensing, partnership acquisition, and corridor prioritisation—helping banks launch compliant services faster.

- Cloud Managed Services provide banks with a resilient infrastructure backbone, supporting real-time settlement and 24×7 availability without internal IT overhead.

- Legacy Migration Support enables seamless transformation from batch-based systems to API-ready, real-time rails without disrupting core banking platforms.

Outcome: Banks launch compliant, digital-first remittance services in weeks—not quarters—while reducing operational drag and compliance risk.

Money Transfer Operators (MTOs): Expanding Reach and Optimising Cost-to-Serve

Challenge: MTOs aiming to scale across new geographies often encounter corridor activation delays, regulatory fragmentation, and operational overheads.

Remittance Technology as a Service (RTaaS) in Action:

- Growth Consulting provides access to 140+ pre-integrated payout corridors supporting instant, same-day, or T+1 settlement with intelligent payment routing logic.

- BPO & Corporate Services offer operational muscle—handling onboarding, reconciliation, exception management, and customer support at scale.

- Compliance Management embeds real-time AML/KYC/sanctions workflows that auto-align with regional standards (e.g., FCA, MAS, FINTRAC), ensuring audit readiness.

Outcome: MTOs scale corridor coverage rapidly while maintaining lean teams, reducing compliance complexity, and optimising cost-to-serve.

FX Providers: Transforming into Cross-Border Remittance Enablers

Challenge: Traditional FX businesses seek to diversify revenue by offering international payouts and wallet-based remittance services—but lack the infrastructure and compliance stack to scale securely.

Remittance Technology as a Service (RTaaS) in Action:

- Go-to-Market Consulting guides FX firms through MSB expansion and partner acquisition to unlock new corridors and use cases.

- Legacy Migration Support transitions proprietary FX systems into modular, real-time remittance-ready platforms powered by NetRemit.

- Cloud Managed Services ensure always-on, secure transaction processing with resilient BCP zones, ideal for volatile corridors and high-volume B2B disbursements.

Outcome: FX providers move beyond currency exchange to deliver scalable, compliant, and differentiated international money transfer solutions.

With NetRemit Remittance Technology as a Service (RTaaS), institutions don’t just gain a plug-and-play platform, they unlock a strategic partner equipped to guide growth, mitigate risk, and accelerate time-to-market. Whether you’re a bank modernising customer remittance journeys, an MTO scaling into new markets, or an FX firm evolving into a international money transfer powerhouse, RTaaS delivers the right combination of infrastructure, intelligence, and institutional support.

FAQs

How is NetRemit different from traditional in-house systems?

Unlike legacy systems that demand long development cycles, high capital investment, and constant compliance maintenance, NetRemit offers a modular, cloud-native Remittance Technology as a Service platform. It comes pre-integrated with corridors, real-time dashboards, and built-in regulatory orchestration—accelerating go-live timelines from months to weeks.

Can NetRemit support my specific payout corridors?

Yes. NetRemit, money remittance software offers access to a broad network of pre-integrated global payout corridors across 140+ countries, supporting B2C, B2B, and wallet-based transfers. New corridors can be added seamlessly via configuration—no coding or custom development needed.

What kind of compliance features are included?

NetRemit embeds compliance directly into the transaction flow with real-time KYC/AML, automated sanction screening, transaction monitoring, and jurisdiction-specific rules aligned with FATF, PSD2, GDPR, PRA, and other global standards—ensuring you’re always audit-ready.

Is NetRemit suitable for both banks and fintechs?

Absolutely. Whether you’re a traditional bank modernising remittance services or a fintech scaling global payouts, our remittance software offers the agility, security, and scalability required—without the overhead of managing infrastructure or compliance in-house.

How quickly can we go live with NetRemit?

Most clients can go live within 4–6 weeks, depending on integration requirements and corridor selection, far faster than the typical 12–18 months required for in-house builds.

Can we white label the remittance platform?

Yes. NetRemit offers fully brandable UI modules that provide a seamless customer experience across web and mobile, enabling you to maintain brand consistency while leveraging our backend infrastructure.

Future-Ready Remittance Technology as a Service

With NetRemit innovate faster, scale smarter, and stay compliant.

Ready to get started?

We can’t wait to show you what’s possible with NetRemit.

Streamlined Cross-Border Payments: Easing Regulatory Hurdles via Interoperability

Cross-border payments are crucial for international trade and connecting economies, but their current landscape is characterised by complexities and inefficiencies. One major factor is the lack of interoperability, which ensures seamless flow of funds between different payment systems and service providers. However, regulatory frictions hinder progress and pose obstacles for market participants, making it difficult for businesses and individuals to effectively manage cross-border payments.

Need for Interoperability in Cross-Border Payments

Interoperability is the seamless integration of different payment systems and networks, facilitating efficient and cost-effective cross-border transactions. It allows for smooth transmission of payment instructions and data formats, minimising disruptions and improving efficiency.

This leads to reduced transaction costs, making cross-border payments more accessible and affordable, especially for smaller businesses and individuals.

Interoperability also promotes financial inclusion by enabling broader access to payment services, empowering underserved populations and stimulating economic growth in regions previously limited by financial services.

Enhancing transparency is another benefit of interoperability. By facilitating seamless data exchange and interoperable systems, it becomes easier to track and monitor transactions across multiple platforms, mitigating risks related to money laundering, fraud, and other financial crimes.

This increased trust among stakeholders promotes a more secure and stable financial ecosystem. Despite regulatory frictions and barriers, interoperability is essential for a more secure and efficient financial system.

Regulatory Barriers in Cross-Border Payments

Regulatory Complexity

Regulatory complexity and inconsistencies are major obstacles to achieving interoperability in cross-border payments. Each jurisdiction has its own set of rules and regulations, creating disparities and inconsistencies that hinder smooth transaction efficiency. For example, payment infrastructure providers in one jurisdiction may have stringent capital requirements, while in another, they may be more relaxed. This can lead to delays, increased costs, and potential breaches in compliance with different standards.

Fragmented Licensing

Fragmented licensing and clearance processes also pose a challenge, as each jurisdiction has its own procedures for approving and licensing payment service providers. This fragmentation impedes the development of interoperable systems and stifles competition and innovation. Fintech companies seeking cross-border payment solutions often face numerous roadblocks when attempting to obtain licenses or approvals in multiple jurisdictions.

Insufficient Collaboration among Regulators from Different Jurisdictions

Inadequate cross-border collaboration among regulators contributes to the lack of consensus on managing money laundering/terrorist financing (ML/TF) risks, fraud, as well as risks posed by new entrants and innovations. Establishing effective cross-border collaborations is a significant challenge for regulators. It often entails careful consideration of geopolitical and technical discussions, requiring a delicate balance of competing interests.

Difference in AML/CFT Regulations

AML/CFT regulations vary across countries, creating challenges in cross-border transactions. These regulations involve complex due diligence processes, requiring thorough customer identification, transaction monitoring, and reporting obligations. Data privacy and security regulations also differ across jurisdictions, making it difficult to ensure compliance with varying standards while facilitating efficient cross-border payments.

Cross-border information sharing is often required to identify and prevent illicit financial activities, but legal restrictions, data protection concerns, and differing frameworks can hinder effective collaboration.

Risk Assessments

Risk-based assessments are required by financial institutions to identify high-risk transactions and customers, but assessing risk accurately across borders can be complex due to differing risk profiles, regulatory requirements, and limited access to information from foreign jurisdictions.

Diverse Levels of Financial Market Development

One factor contributing to regulatory frictions is the varying stages of development in financial markets across different jurisdictions. This often aligns with disparities in economic development. For instance, emerging markets may have experienced rapid growth in non-bank payment service providers (PSPs) due to limited regulatory oversight. This fosters innovation and progress but also exposes markets and consumers to regulatory arbitrage and systemic hazards.

The Lack of Public-Private Partnerships (PPP)

This factor hinders the possibility to utilise industry knowledge, technological progress, and creative strategies to tackle regulatory challenges. PPPs are crucial for combating cross-border criminal activities, designing appropriate regulatory approaches for innovations, and promoting competition to provide better services to consumers.

Resource Constraints

Resource constraints including trained personnel, advanced technology systems, and ongoing monitoring also pose challenges for smaller financial institutions or emerging market economies, limiting their ability to effectively engage in cross-border payments.

Overcoming Regulatory Frictions in Cross-Border Payments

Harmonisation of Regulatory Frameworks

Harmonisation of regulatory frameworks across nations can aid in the elimination of regulatory obstacles in cross-border transactions. This entails creating globally recognised, standardised regulations in order to lessen the uncertainty that arises from regulatory inconsistencies.

Through cooperative efforts with regulators and policymakers, international organisations such as the Financial Stability Board and the Basel Committee on Banking Supervision can effectively contribute to the harmonisation process by establishing a shared set of principles and standards for cross-border payments.

Regulatory Sandboxes

Regulatory sandboxes are safe havens where fintech companies can experiment and introduce cutting-edge goods and services while being watched over by authorities. Using this method, regulators can evaluate the possible effects of these innovations on regulatory frameworks by seeing how they operate in actual settings.

The identification of more efficient and effective regulations can result from the successful implementation of regulatory sandboxes, which will lessen obstacles in cross-border transactions.

International Collaboration and Agreements

Overcoming regulatory obstacles in cross-border payments can also be aided by more international collaboration and agreements. Bilateral or multilateral agreements can be made by regulators and governments to make cross-border payment system integration and money transfers easier. By working together, regulatory bodies may create uniform guidelines for fraud prevention, anti-money laundering, and consumer due diligence, which would promote openness and confidence in international trade.

Promotion of Public Private Partnerships

Given the importance of the payment sector to trade and business, cooperation between the public and private sectors is necessary to guarantee safe, effective, and convenient cross-border payment systems.

To create an efficient PPP, regulators must incorporate a wide group of industry participants from different payment methods and roles in the cross-border payments value chain. This builds trust, transparency, and interaction. It is recommended that streamlined compliance, lower expenses, and efficient risk management be promoted. In addition, PPPs can strengthen risk management protocols, provide strong security measures, and make information exchange easier to tackle possible risks and weaknesses.

Successful PPPs have the potential to boost innovation and lower entry barriers for new competitors. Partnerships encourage collaboration, knowledge sharing, and resource access, promoting payment service and technology innovation and industry competition. This gives customers more options and facilitates fair competition among participants. To promote public sector outreach and seminars, the FSB and CPMI are hosting an annual payments summit.

Modernising Regulatory Frameworks

It is recommended to modernise regulatory frameworks in the fintech sector to reduce compliance costs by aligning regulations with specific activities, rather than licensed entities. This will ease PSPs’ burden, especially when fintech or bigtech entities have minimal systemic impact.

A hybrid regulatory approach, combining entity-based and activity-based regulation, will enhance security in cross-border payments by providing comprehensive oversight, minimising regulatory arbitrage, and offering clear guidelines for innovation. This will also reduce barriers for entry, leading to better pricing and services for end users, improving financial inclusion.

Broadening access to domestic payment systems will simplify compliance and reduce costs. This will also promote common standards and technology adoption by expanding PSPs’ access to payment systems.

Incorporation of Technological innovations

The security and privacy of cross-border transactions can also be improved by technological advancements like distributed ledger technology (DLT), blockchain, digital IDs, and biometric authentication. These advancements can do away with the need for tedious and inconsistent identity verification procedures.

NetRemit To Facilitate Interoperability

Macro Global’s NetRemit is intended to assist banks and other financial institutions in overcoming regulatory obstacles and enabling interoperability. Built on a compliance-first platform,

NetRemit offers features and tools like built-in KYC databases, real-time transaction monitoring for suspicious behaviour, and artificial intelligence and machine learning-based fraud detection to assist financial institutions in managing compliance risks.

It also assists financial institutions in adhering to anti-money laundering (AML) laws by continuously observing all transactions for any unusual behaviour.

A multitude of payment networks and systems are compatible with NetRemit. It also offers adapters and APIs to let financial institutions integrate their systems. A strong regulatory framework, a range of payment options, and a global network of banking partners all contribute to its interoperability.

Financial organisations can benefit from NetRemit’s lower costs, increased speed and efficiency, broader reach, and lower risk. Notably, it is scalable and flexible to changing needs because of its microservices architecture, API-first design, machine learning and artificial intelligence algorithms, and cloud-based platform.

Ready to get started?

We can’t wait to show you what’s possible with NetRemit.

The Insider’s Handbook: Acquiring a Money Transfer License in Europe

Recently, fintech activity in the EU, especially in the UK, has surpassed the US market. Through revisions of the Payment Services Directive (PSD2) and European Banking Authority Guidelines, the EU has spent much in creating a favourable and creative regulatory framework.

Because of such an advanced regulatory framework and thriving startup community, Europe has emerged as a global leader in the financial technology sector.

Furthermore, the EU passporting system for financial institutions allows businesses authorised in any EU or EEA Member State to function legitimately in any other with a little more authorisations. The regulatory tools helped create a level playing field for foreign fintechs entering the European Union.

When starting a money transfer business in the European Union (EU) and the United Kingdom (UK), it is required to obtain either a Payment Institution License or an Electronic Money Institution License based on the type of services the business decide to offer.

Prerequisites to obtain Money Transfer License in Europe

Certain requirements must be satisfied in order to receive either a Payment or an E-Money License. The range of services offered, and the initial capital requirement are two of the most critical factors to consider during the preliminary preparation phase.

Alongside the domestic proposals by European Union Member States, the licencing requirements for Payment Institutions and E-money Institutions are specified in the revised PSD2 (Directive (EU) 2015/2366) and E-Money Directive or EMD2 (Directive (EU) 2009/110/EC) respectively.

A degree of discretion is granted to Member States regarding the incorporation of EU Directives into domestic law. This indicates that the EMD2 and PSD2 are likely to have small variations between the various EU Member States.

Types of Money Transfer License in Europe

Payment Institution License

It is widely accepted that the Payment Institution License is the best option for European payment gateways and e-commerce sites seeking a license to operate legally. Payment service providers who handle corporate payments and individual money transfers benefit greatly from obtaining a PI License.

According to the PDS2 Directive, a payment institution license may provide the following services:

- Payment account services that allow for deposits to and withdrawals from an account, as well as all other account-related tasks.

- Performing financial transactions (such as a direct debit, a payment card transaction, a credit transfer, or an active order)

- The issuance of payment instruments and/or the acquisition of payment transactions.

- Money remittance

- Payment initiation services

- Access to Financial Account Details

E-Money Institution License

E-money institutions are fintechs that have been granted permission to issue electronic money in compliance with the EMD2 implementation in each individual EU member state. Electronic money constitutes the foundation of e-money institutions.

The European Central Bank (ECB) defines e-money as an electronic version of physical currency that is capable of being utilised for transactions with third parties.

This enables consumers to conduct contactless transactions using a mobile device, credit card, or the internet.

E-money institutions offer their customers access to cutting-edge financial services. Customers can make payments using EMIs (Electronic Money Institutions)’ e-money payment accounts without requiring a bank account.

A business that wants to issue electronic money via electronic wallets, IBAN accounts, and payment cards must apply for an electronic money institution license.

Application Process for Obtaining Money Transfer License

Preparing the Application

- Identify the target jurisdiction and ensure the legal structure and capital requirements are met.

- Craft a compelling business plan, defining your niche, tailoring to your target audience, using clear language, and being realistic and optimistic in forecasting growth potential. Emphasise your management team’s expertise and experience, with a particular focus on finance, technology, and regulatory compliance.

Essential Documents for Application

It is mandatory to include the following with your licencing application:

- Strategic business plan

- Structure of the organisation

- Proof of minimum paid-up capital

- Details on internal control mechanisms such as Risk management, accounting procedures

- Identity documentation for the applicant, directors, and shareholders

- Legal status of the applicant and articles of association

- Head office address of the applicant

Additional regulations may apply depending on the jurisdiction. Make sure you submit a comprehensive application with necessary documents/information to avoid rejection.

Application Submission

The application is accompanied by all required documentation and submitted to the relevant regulatory body, which in the case of the United Kingdom is the Financial Conduct Authority (FCA).

Application Review and Due Diligence

- The regulatory body examines the company’s financial stability, expertise, and compliance procedures.

- Besides, due diligence checks, including background checks on key personnel and directors, may be performed.

Compliance Assessment

- Regulations pertaining to data protection, risk management, financial crime prevention, and anti-money laundering are evaluated for compliance.

Approval for Regulation

- Once the application receives regulatory approval, the company is granted a provisional license.

- During this stage, further conditions such as regular reporting or mandatory audits may be imposed.

License Issuance

- After meeting all requirements, the company is issued a money transfer license, allowing it to operate within the specified jurisdiction.

- This license provides a clear framework for the licensed entity.

Time Frame for obtaining Money Remittance License

The time duration for obtaining a money transfer license can vary significantly between six months and one year based on the jurisdiction and complexity of the application, as well as the efficiency of the regulatory body and compliance procedures. Also, the business plan, documentation availability, and response time to regulatory queries may also delay the process.

Compliance

In Europe, money transfer businesses need to comply with stringent regulatory standards such as

- AML/CFT legislation: To implement robust security systems and protocols that combat money laundering and funding of terrorism.

- Data protection regulations: To preserve the privacy and safety of customer information.

- Consumer protection regulations: To furnish customers with clear and concise information, upholding their rights and protecting their interests.

Capital Requirements

To obtain PI License, the company requires a minimum paid-up capital of EUR 125,000 for various operations, including deposits, withdrawals, fund transfers, credit transfers, payment instrument issuance, and transaction acquisition, and a minimum capital of EUR 20,000 for money remittance services and EUR 50,000 for payment initiation services.

To obtain an EMI License, EMIs must have a minimum starting capital of EUR 350,000 according to Article 4 of the EMD2.

Technology and Infrastructure: Facilitating Seamless Operations

The success of money transfer businesses in this digital age depends primarily on infrastructure and technology which guarantees compliance and the smooth functioning of operations.

Money transfer businesses must choose a reliable payment platform to provide real-time transaction monitoring, support multiple currencies, and comply with international data security standards. It should also be scalable for growth.

Embracing the latest technologies like artificial intelligence (AI), block chain technology, and automation can streamline operations, promote secure data transfer, and increase efficiency.

Automation of repetitive tasks helps in reallocating resources towards other important activities. Furthermore, the implementation of AI in customer support, fraud detection, and risk assessment can effectively reduce operational risks.

Stay Updated of Challenges and Pitfalls

Despite getting a money transfer license in Europe featuring a wide range of opportunities, it comes with its share of challenges and risks. Businesses can more skillfully manage the regulatory landscape by being aware of these challenges.

It is critical to remain updated with the ever-changing regulatory requirements. Overlooking how to adapt to regulatory changes could result in violations of compliance and damage the reputation of the business. Therefore, it is critical for businesses to establish procedures for effectively monitoring and implementing regulatory updates.

A European money transfer license needs significant investment and strict compliance. New entrants may be deterred by the substantial entry barriers, whereas established participants encounter difficulties due to the fierce competition. To succeed, differentiate your offerings, provide excellent customer service, and innovate.

Post-License Operations: Beginning of New Era

Obtaining the European money transfer license is just the beginning. Sustaining compliance and growth is of utmost importance.

It is crucial to detect and prevent fraudulent activities through the implementation of robust compliance monitoring mechanisms. The execution of routine audits, employee training initiatives, and ongoing transaction monitoring can significantly enhance the ability to detect and mitigate risks. Businesses can gain regulatory and customer trust by prioritising compliance.

Strategic partnerships and service expansion can help money transfer businesses to excel. Working with trustworthy banks, offering novel payment solutions, and targeting niche markets can boost revenue, customer satisfaction, and consequently business expansion.

NetRemit: Unlocking Global Opportunities & Empowering International Money Transfers

NetRemit, a white-labelled SaaS cross border payment platform, is a key player to empower international money transfer business. NetRemit ensures secure and seamless money transfers for your customers.

Also, NetRemit offers a convenient and cost-effective solution for individuals and businesses to send and receive money across borders. NetRemit prioritises compliance, leverages advanced technology, incorporates high-level security protocols, navigates the regulatory landscape effectively, and offers extensive customer support, thereby helping businesses to establish themselves as trusted entity in the money transfer industry.

Reach out to us to learn about NetRemit and transform your cross-border money transfer business successfully.

Ready to get started?

We can’t wait to show you what’s possible with NetRemit.

Idea to Reality: How to Start a Money Transfer Business in the USA

The money transfer sector has experienced substantial expansion in recent times. Analysts anticipate that worldwide remittance inflows will have surged by an estimated USD 930 billion by 2026, thereby bolstering the economies of participating nations.

Starting a money transfer firm is exciting and rewarding. To be successful, though, demands thoughtful preparation and execution. From creating a business plan to establishing customer service infrastructure and launching a marketing campaign, this blog will cover every aspect of getting your money transfer business off the ground.

The 10 Steps It Takes to Start a Money Transfer Business in USA

Market Research

- It is imperative to perform a comprehensive market investigation before entering the money transfer industry. This enables the identification of prospective consumer segments, awareness of their requirements, and establishment of a competitive edge. Additionally, analysing the current market landscape and competitors’ services can help you position your business effectively.

Create a Business Plan

- A meticulously devised business plan is essential for guaranteeing the success of a money transfer firm. Establishing a distinct strategy and defining your business model will provide direction for your operations. Consider whether your money transfer business will serve local communities, regions, or the world. Based on that, the business plan and marketing initiatives could be crafted.Evaluating the financial requirements, such as initial and recurring costs, will assist you in identifying funding sources and locating investors, if necessary. Finally, a detailed marketing plan and advertising techniques will help you build a solid consumer base.

Legal & Compliance Requirements

Money transfer businesses in the United States must comply with federal, state, and local regulations to prevent money laundering and filing a FinCEN Form 107 with the U.S. Treasury Department’s Financial Crimes Enforcement Network (FinCEN) is mandatory to ensure that your company is not involved in it.

- Mandatory Documents for Legal Operations include:

- Certificate of Incorporation

- Operating Agreement

- Business License and Certification

- Business Plan

- Non-Disclosure Agreement

- Insurance Policy Employment Agreement

- Money Services Business Application form

- Money transmitter license

- Online Privacy Policy Document

- Online Terms of Use

- Apostill

As the establishment of a money transfer business under the Bank Secrecy Act takes 180 days and obtaining license can be time-consuming and costly, it is advantageous to hire a Certified Anti-Money Laundering Specialist (CAMS) as the compliance officer.

License Types in the United States

Money Transmitter License (MTL):

With this license, MSBs can transfer funds within the state of the US in which they are issued. Additionally, specific operations, such as currency exchange or cheque processing, require distinct licenses.

Money Services Business (MSB) License:

This license is mandated for money transfer businesses that engage in foreign exchange transactions exceeding $1,000 per transaction or $3,000 per day. It’s obtained online by registering with FinCEN.

Bank Secrecy Act (BSA) Compliance:

Every money transfer business must comply with the BSA’s Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations to prevent money laundering and terrorist financing by establishing essential policies and processes.

State-Specific License:

Each state may have very different licensing standards and application procedures. Certain states impose additional Licensing prerequisites on money transfer businesses. Doing extensive research on state regulations helps you reach your target market.

Multi-State Operations:

You could require an MTL in each state if you want to conduct business in more than one state. To streamline Licensing across many jurisdictions, you may choose to apply for a Nationwide Series Money Transmitter License (NMLS MT License).

Licensing Process in the USA

Communicate with State Regulators:

Determine the precise Licensing prerequisites for your business model by contacting the financial regulator of your state.

Fill out the Application:

Complete the application forms with diligence, ensuring that you include all essential documentation, including business plans, financial statements, and background checks.

Fee Payment:

Acknowledge and remit the mandatory application fees and processing costs.

Clear Background Checks:

All important employees in your company will probably go through background checks which need to be passed by them.

Compliance Training:

Finish any compliance training courses that the authorities have mandated.

Build, Partner, or Buy Your White Label Remittance Solution

When starting a money transfer business, choosing the right software approach is vital. You have three main options Build, Partner, or Buy.

Build: Developing a custom software solution from scratch offers control but has significant challenges. This option requires substantial financial investment, extensive time, and technical expertise. The complexities of development, ongoing maintenance, embracing technology advancements and the need to stay ahead of regulatory changes make it a resource-intensive and risky approach.

Partner: Partnering with an established software provider may seem like a balanced option, but it has its drawbacks. You may face limitations imposed by the provider, lack full control over platform functionalities, and deal with potential revenue-sharing arrangements. Your ability to differentiate your services could be compromised, and you may be dependent on the provider’s pace for updates.