Simplify FSCS Reporting. Ensure Compliance with Confidence.

Effortlessly manage your regulatory compliance requirements with the All-in-One FSCS SCV Enterprise Solution Suite, a proven, mature solution for single customer view reporting.

Banks

Products

Client Audits from year 2010

Audit Checkpoints

Struggling with complex regulatory requirements? Discover 10th Gen SCV platform for FSCS reporting

Fully tried and tested Single Customer View reporting platform to all your challenges around FSCS regulatory reporting, provides

High-quality Data Aggregation

Fully automated intelligent Single Customer View reporting platform seamlessly integrates data, manages account segregations, and generates SCV reports quickly, reducing human risk and maintaining data accuracy.

Complete Data Management

Easily integrate with any CBS, enable multi-level data validations with AI-based fuzzy logic, prevent data duplication, and generate accurate SCV reports on demand for FSCS submission.

Guaranteed Data Privacy & Compliance

Adheres to ISO standards and FSCS compliance requirements with robust data security throughout the regulatory lifecycle, featuring hierarchical security, advanced encryption, and a complex password mechanism to protect SCV output files.

Our All-in-One FSCS SCV enterprise solution suite minimises compliance risks, streamlines report generation and ensures PRA “Green Status Adherence,” for

Featuring a comprehensive out-of-the-box reporting solution with automation and audit capabilities, elevating your FSCS SCV regulatory reporting to the next level

Our FSCS SCV Enterprise Solution Suite enhances operational efficiency by reducing workload by 30%, and ensuring data accuracy.

- Full audit history for data quality benchmarking and remediation tracking.

- Group-based user management with role-based access control.

- Customisable bank configuration for validation rules, exclusions, and business logic.

- SSIS & Power BI integration for advanced reporting and analytics.

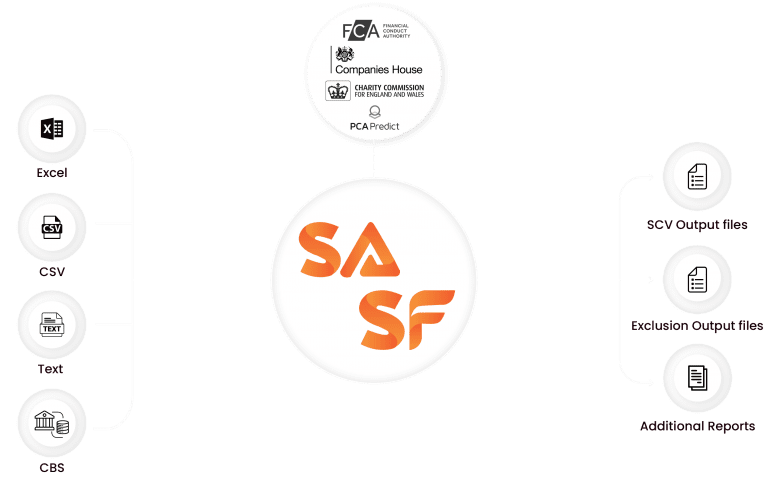

- Seamless third-party integration with FCA DB, Royal Mail DB, Companies House, OFAC, and more.

- SSIS-Based ETL Platform ensures high-performance data integration, minimising risks and delivering precise reporting.

- Seamless system integration connects effortlessly with core banking systems and legacy platforms for smooth data import.

- AI-driven accuracy eliminates human error, automates reconciliation, and maintains a full audit trail.

- Robust data governance enhances quality, enrichment, and reconciliation, ensuring complete and fully compliant SCV reports.

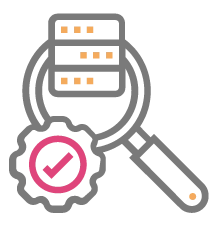

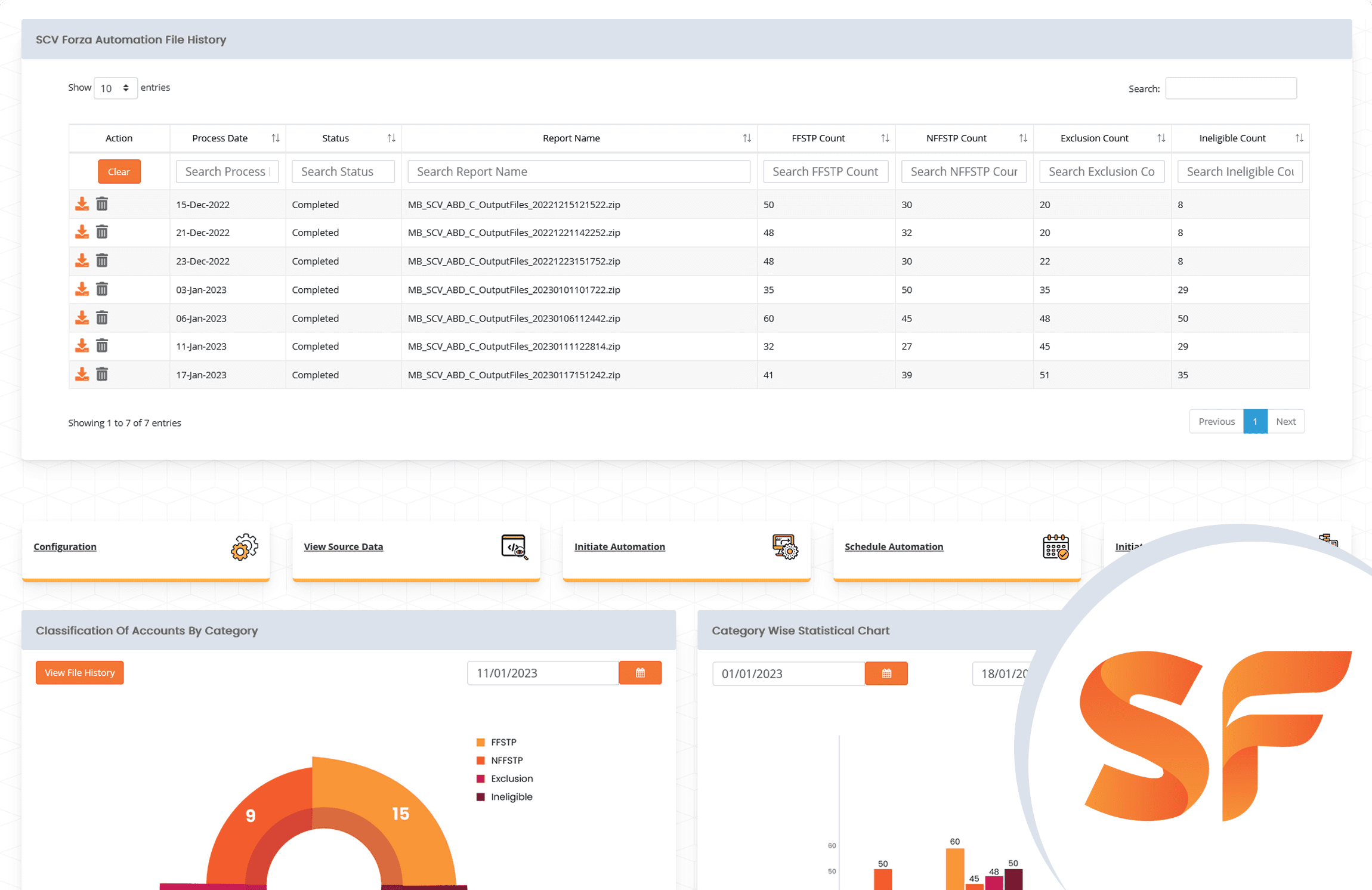

SCV Alliance – FSCS SCV Audit Platform

- Full audit history for data quality benchmarking and remediation tracking.

- Group-based user management with role-based access control.

- Customisable bank configuration for validation rules, exclusions, and business logic.

- SSIS & Power BI integration for advanced reporting and analytics.

- Seamless third-party integration with FCA DB, Royal Mail DB, Companies House, OFAC, and more.

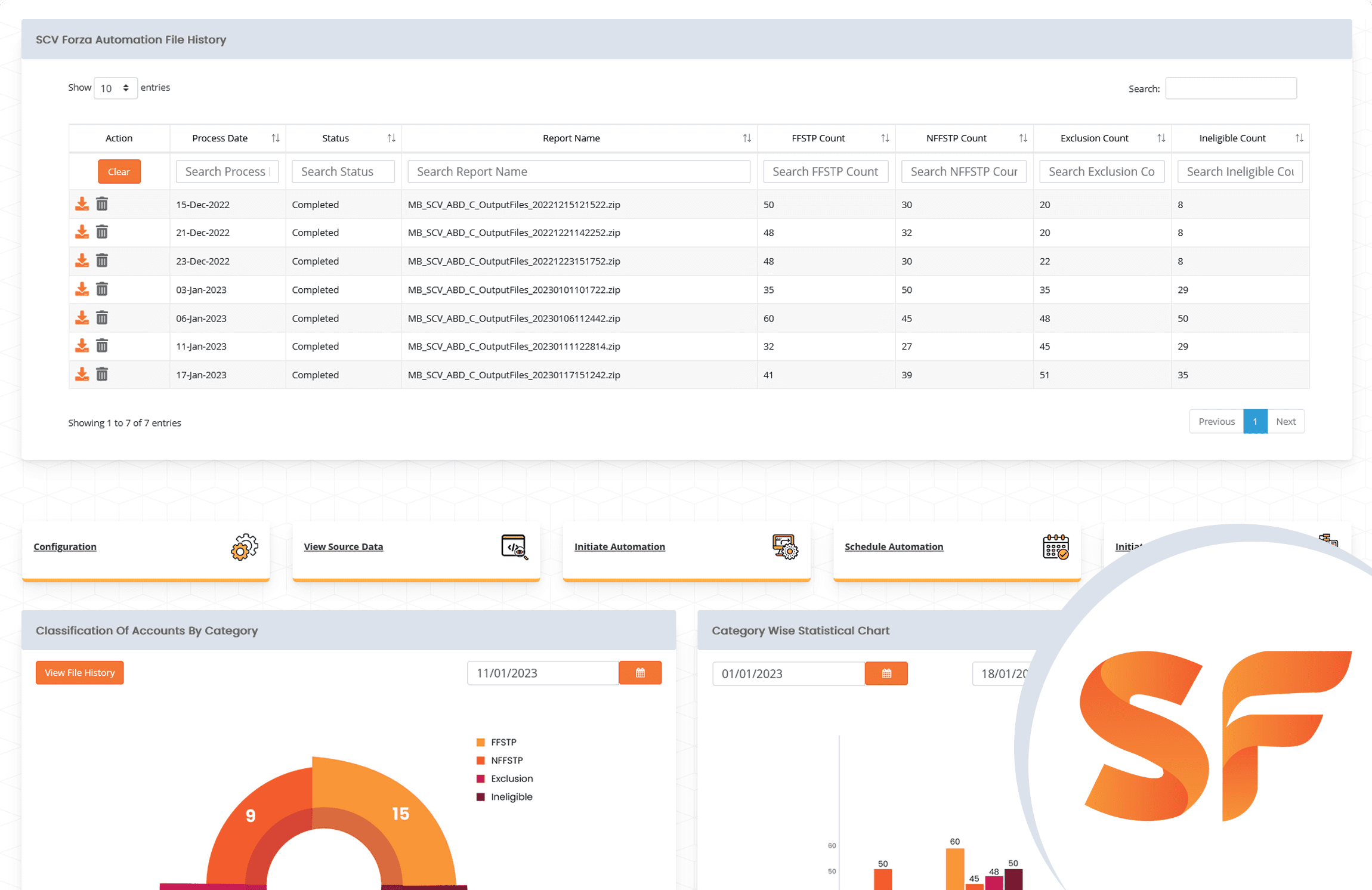

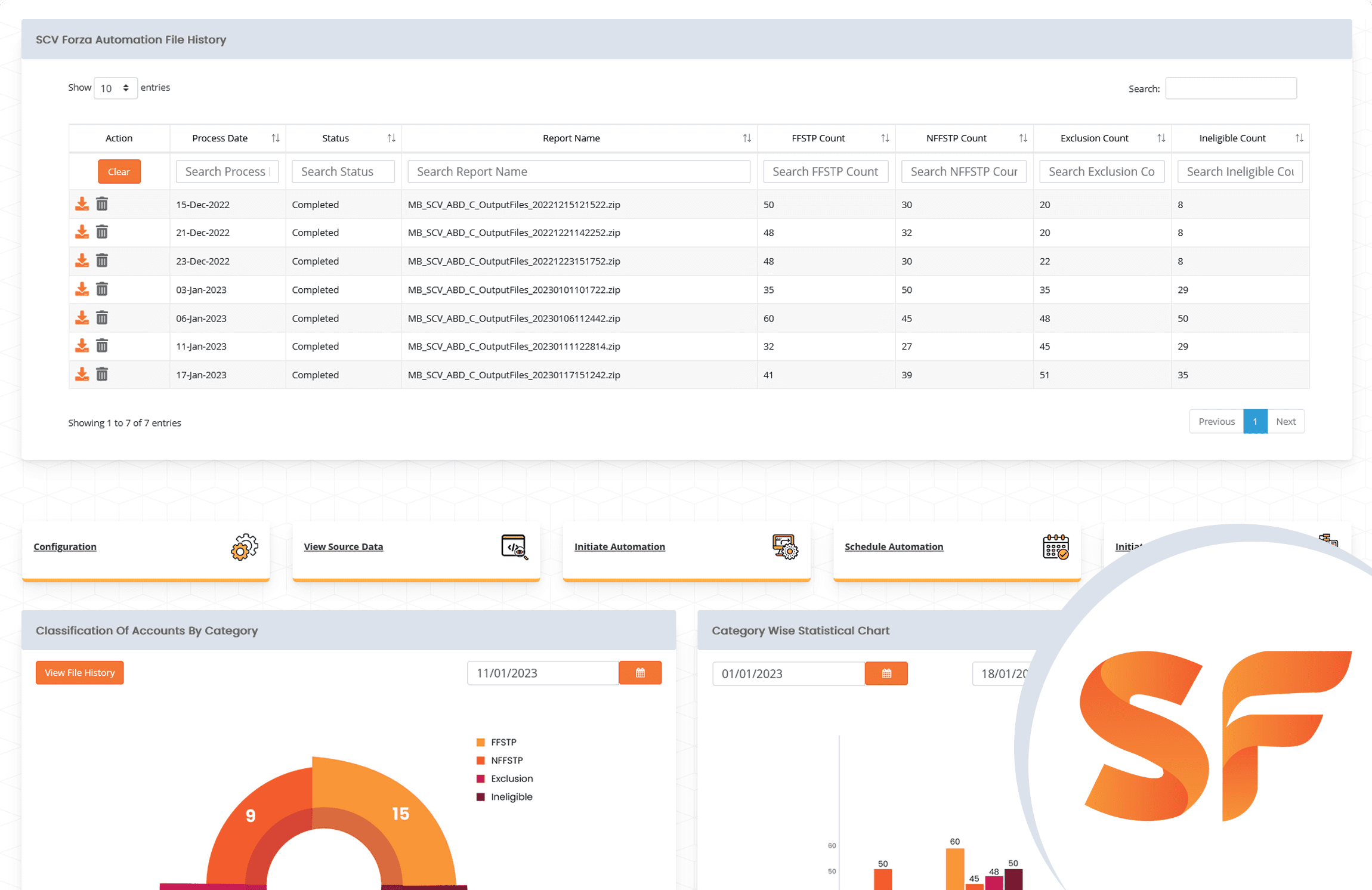

SCV Forza - FSCS SCV Automation Platform

- SSIS-Based ETL Platform ensures high-performance data integration, minimising risks and delivering precise reporting.

- Seamless system integration connects effortlessly with core banking systems and legacy platforms for smooth data import.

- AI-driven accuracy eliminates human error, automates reconciliation, and maintains a full audit trail.

- Robust data governance enhances quality, enrichment, and reconciliation, ensuring complete and fully compliant SCV reports.

Generate SCV Reports in 5 Simple Steps – Fast, accurate, and hassle-free FSCS compliance

Collect & Cleanse

Gather customer and account information from multiple sources and eliminate inconsistencies.

Structure & Enrich

Elevate data quality with intelligent validation and enrichment.

Validate & Transform

Apply smart business rules and compliance checks to ensure accuracy.

Audit & Screening

Perform rigorous checks and validate data with external databases.

Generate & Comply

Generate and submit FSCS-compliant SCV reports with confidence.

Looking to achieve "Green Status Adherence" with PRA and build customer trust?

Our All-in-One FSCS SCV Enterprise Solution Suite has you covered!

Key Features

Stay on top of FSCS SCV compliance and meet regulatory deadlines with confidence

Well Classified 175 SCV Audit Checkpoints to track and report potential High & Medium risk data issues.

Third-party integrations to validate data against FCA DB, Royal Mail DB through API, Companies House, Charities Register, BFPO Address, OFAC Sanction customer check.

Data Mining, Data Cleansing, Data Enrichment and Reconciliation functionalities to identify and remediate data-related issues and inaccuracies.

Full Audit history and facility to compare previous ones to benchmark and track metrics for data remediation.

AI-based algorithms to identify inaccurate customer & account holder information, account segregations, data duplication and more.

Fully automated straight through processing ensures validation, data enrichment, account/customer rule management, and real-time reconciliation with a complete audit trail.

Why Choose Our FSCS SCV Enterprise Suite?

Trusted by major banks and FIs over 10 plus years to complete their FSCS SCV submissions accurately in time

All-in-One FSCS SCV Enterprise Solution Suite, a data-driven compliance platform for financial institutions to effectuate the regulatory requirements.

Be ahead of your peers

Periodic upgrades to ensure customers stay ahead of compliance in the ever-changing regulatory environment. You can fully rely on quality and integrity.

Fulfilment / Peace of Mind

Gain peace of mind with our FCA-recognised FSCS SCV reporting solution, ensuring seamless electronic submissions to RegData with accuracy and security.

Operational Efficiency

Boost efficiency by eliminating manual inefficiencies and accelerating account balance reconciliation between systems.

Reduce Risk

Our advanced matching algorithms, preset business rules, and automated validation minimises compliance risks, ensure accuracy, reducing operational losses and strengthening regulatory control.

Rapid turnaround

Our FSCS reporting solution gives users the competence to drill down their data to any level of granularity with the ability to track, monitor, remediate and scale up your data with minimal man-hours.

Strategic Guidance

Expert business consulting to optimise data governance and gain operational best practices in the FSCS reporting landscape.

We do not spare any effort in ensuring data security and compliance

Fully compliant with industry standards, our FSCS SCV Enterprise Solution Suite ensures robust data protection on a secure Azure Cloud with flexible architecture and multi-factor authentication.

Complies with ISO & OWASP standards

SOAP API services

Secure data capture

Robust 256-bit Encryption

Behaviour-based security captcha

Parameter-level validation

Microsoft Enterprise Grade Security

Strong customer authentication

Stringent data retention policies

Periodic VAPT to the webserver

URL copy prevention

Session Management

Latest framework with MVC standards

IP restrictions for Admin Portal

Malware Protection

3D Secure authentication

SAS, EIT, EAR, NLC, Physical and Web App Level Firewall

Asymmetric AES with RSA encryption/Diffie-Hellman

JWS to eliminate complicated installation/upgrading procedures

GUID Implementation

We ensure you seamless FSCS Single Customer View reporting for a future-ready business

Navigate the evolving business landscape with ease using our FSCS SCV compliance solution, designed to help banks and FIs stay ahead with three essential steps for seamless regulatory adherence.

We help you define your compliance future

We clarify your near-term and long-term regulatory goal with our FSCS compliance expertise. You can keep your focus on growing your business and leave the FSCS regulatory compliance burdens on us.

We help you be proactive for compliance disruption

The regulatory goal-post is ever changing. We do the heavy-lifting and empower you to navigate those uncertainties with ease, ensuring seamless FSCS compliance and business continuity.

We help you to stay ahead of the curve and resilient

We make you stay ahead of your competitors. Learn the FSCS regulatory compliance changes from our experts in advance and deploy and manage your FSCS Single Customer View reporting proactively.

Banks & financial institutions across the world are building their digital transformation journey through our platforms

Our Knowledge Base Resources

CASE STUDY

Unlocking Data Accuracy & Security: Macro Global's Key to The UK Bank's SCV Reporting Success

CASE STUDY

Bridging the Data Gap: A Building Society's Journey to Efficient FSCS Reporting

CASE STUDY

Excel to Excellence: Modernising FSCS Regulatory Reporting in Building Societies

WHITEPAPER

Revolutionising FSCS SCV Reporting: Ensuring Data Accuracy and Integrity by Resolving Technology Challenges

WHITEPAPER

Empower Credit Unions with a Data Management Edge: Mastering FSCS SCV Reporting with MG

WHITEPAPER

FSCS Regulatory Reporting on Cloud: Cloud Adoption of FIs

BUSINESS CASE

Macro Global's SCV Approach and Implementation

BUSINESS CASE

Reconciliation support with CBS Data Reporting

BUSINESS CASE

Data Augmentation with Data Enrichment Process

FAQs

What Is FSCS Protection?

The Financial Services Compensation Scheme (FSCS) is a UK government-backed protection mechanism that covers customers of financial institutions that are insolvent.

Key points regarding FSCS protection:

- Government-backed

- Safeguards deposits, investments and general insurance plans with no upper limit are already protected by FSCS.

- There are restrictions on the amount of compensation that can be sought.

Who Is Covered by the FSCS?

The Financial Services Compensation Scheme (FSCS) covers the following entities and the individuals who fall under these groups:

- Banks

- Building societies

- Credit unions

- Debt management firms

- Funeral plan providers

- Insurance companies

- Insurance brokers or financial advisors

- Investment firms

- Mortgage providers

- Payment protection insurance (PPI) providers

- Pensions providers

- Mutual Societies and Friendly Societies

It’s important to note that eligibility for compensation under FSCS is subject to meeting specific criteria and limits set by the UK regulators, the Financial Conduct Authority, and the Prudential Regulation Authority.

FSCS excludes certain entities, such as investments in peer-to-peer lending, smaller financial products such as pre-paid currency cards and financial services from PayPal, credit unions not authorised by the PRA and the FCA, and investments in non-UK-registered firms. Additionally, FSCS does not cover claims for poor investment performance, company failure due to market forces or poor business decisions, or claims for inconvenience, distress, or disappointment.

To know extensively who are eligible under FSCS protection, click this link:

https://www.fscs.org.uk/check/ and get informed.

When Do the Deposit Takers Submit an SCV File?

Deposit takers must submit a SCV file to the PRA or the FSCS within 24 hours of a deposit takers failure or at the request of the PRA or the FSCS. The 24-hour timeline applies on weekends and public holidays. It is critical for determining potential compensation obligations in the event of insolvency.

What Is FSCS SCV Effective Reporting?

FSCS SCV Effectiveness Report is a report that firms must submit to the FSCS or Prudential Regulation Authority (PRA) upon request.

The report must include information about the firm’s SCV system, how it is implemented, and any keys or code utilised internally.

This information helps the FSCS evaluate the firm’s systems and processes and identify areas for reform.

Firms must also update their SCV effectiveness report annually, including a statement about any major system modifications from the preceding report.

What Is Exclusion File In SCV?

The Exclusion file is a crucial component of the Single Customer View (SCV), which includes customer and depositor information, associated accounts and deposits. The Exclusion file specifies the sort of exclusion from the SCV file, including legally disputed, legally dormant, sanctioned, and beneficiary accounts.

What Is the Reporting Format for Submitting the SCV Exclusion File?

Three SCV Formats:

Format 1: Separate files for each table: customer details, contact info, account details, and aggregate balance details.

Format 2: Two separate files: first contains customer, contact, and aggregate balance details, second accounts details.

Format 3: Combines all four tables into a single file.

What Types of Files Are Accepted by FSCS In Reporting?

The FSCS accepts three file types: Excel (.xlsx), XML (.xml), and Text (.txt or.csv).

How Are the Accounts Excluded Under the SCV Exclusion File?

The excluded accounts typically fall into the following categories:

- Sanctioned accounts: Accounts associated with individuals or entities on a sanctions list.

- Legally disputed accounts: Accounts with formal notices of conflicting claims or legal disputes.

- Legally dormant accounts: Accounts with no depositor-initiated transactions for a specified period.

- Beneficiary accounts: Accounts held on behalf of or for the benefit of another person.

What Currency Denomination Is Offered on Submitting FSCS SCV Reporting?

Compensation from FSCS is paid out in Pound Sterling. The SCV should display the Pound Sterling equivalent of foreign currency balances, as well as the corresponding exchange rates. The Exchange Rate in the SCV and Exclusions View files should be current as of the date demanded by FSCS or the PRA. In general, the spot rate set by the Bank of England is recommended.

Still not convinced? Hear what our clients say

IT Manager, Bank Sepah International plc

London

We have been working with Macro Global for good 7+ years and the team is unique with their approach and hold their patience with limitless iteration to resolve the problem by engaging great attention to detail on root cause analysis. We can rely on them in almost on all critical priorities and their support is second to none. Great bunch of professionals and we look forward working with them for the foreseeable future.

Risk Governance Manager, Riyad Bank

London

RBL has worked with Macro Global for over three years. We find their service to be first class. The team are exceptionally helpful and professional. In our opinion we couldn’t ask for a better business provider and would recommend Macro Global to all concerned.

Head of Compliance, Bank of India U.K. Operations

London

Pleased with the timely delivery, excellent service standards, easy accessibility and professional approach of the Macro global team. From our business experience of the past 5 years, we can say it is a reliable, growing outsourcing firm excelling in execution, customer support and delivery commitments, and helping us to meet the regulatory reporting targets.

Head of Operations, IT & Facilities, ICICI Bank UK Plc

London

I feel that the team at Macro Global is amongst one of the best I have ever interacted with in my career. Their expertise in the subject matter, understanding and documentation of processes, detailing of every step of the project and ability to deliver on regulatory reporting (SCV & CRS) and technology platforms (PSD2) amid tight timelines is commendable. This coupled with an visionary leader – Saro, guiding them is a sure-shot recipe for success. I wish them best of luck and am sure they will grow to even greater heights!

Head of Compliance, Bank of India U.K. Operations

London

Pleased with the timely delivery, excellent service standards, easy accessibility and professional approach of the Macro global team. From our business experience of the past 5 years, we can say it is a reliable, growing outsourcing firm excelling in execution, customer support and delivery commitments, and helping us to meet the regulatory reporting targets.

Risk Governance Manager, Riyad Bank

London

RBL has worked with Macro Global for over three years. We find their service to be first class. The team are exceptionally helpful and professional. In our opinion we couldn’t ask for a better business provider and would recommend Macro Global to all concerned.

Head of Operations, IT & Facilities, ICICI Bank UK Plc

London

I feel that the team at Macro Global is amongst one of the best I have ever interacted with in my career. Their expertise in the subject matter, understanding and documentation of processes, detailing of every step of the project and ability to deliver on regulatory reporting (SCV & CRS) and technology platforms (PSD2) amid tight timelines is commendable. This coupled with an visionary leader – Saro, guiding them is a sure-shot recipe for success. I wish them best of luck and am sure they will grow to even greater heights!

IT Manager, Bank Sepah International plc

London

We have been working with Macro Global for good 7+ years and the team is unique with their approach and hold their patience with limitless iteration to resolve the problem by engaging great attention to detail on root cause analysis. We can rely on them in almost on all critical priorities and their support is second to none. Great bunch of professionals and we look forward working with them for the foreseeable future.