FSCS SCV REGULATORY REPORTING SOLUTION

Transform FSCS Reporting from Burden to Breeze. Discover Automation

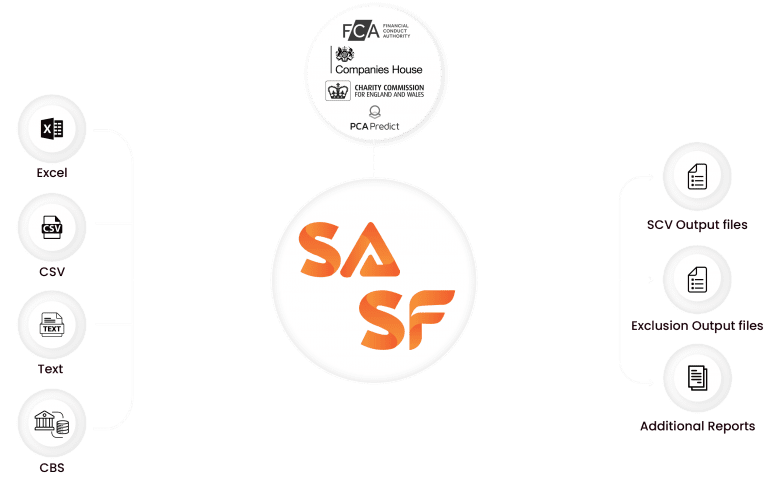

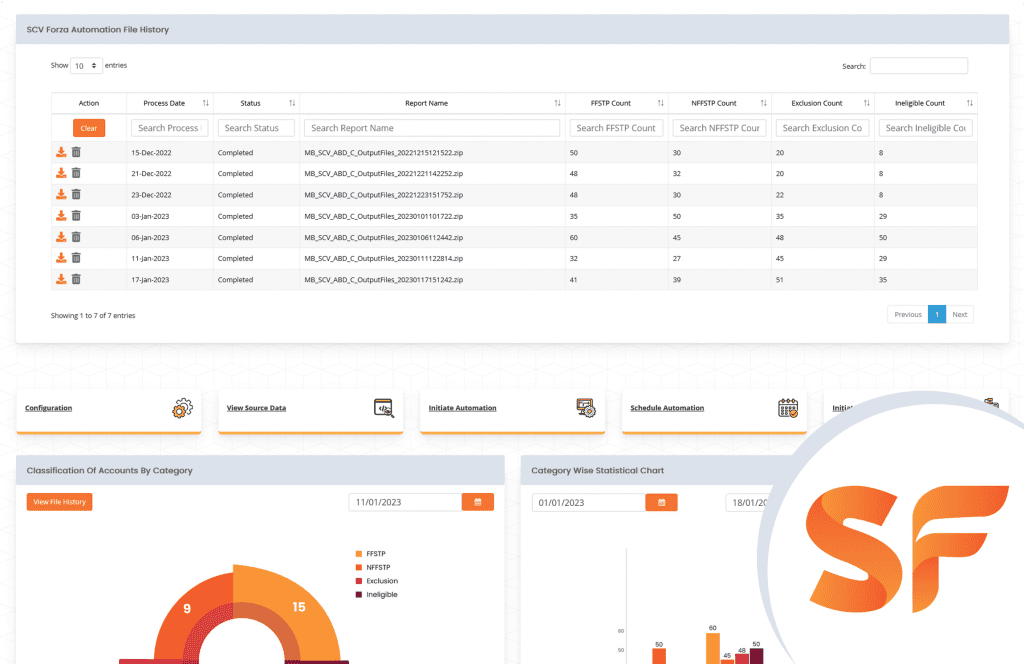

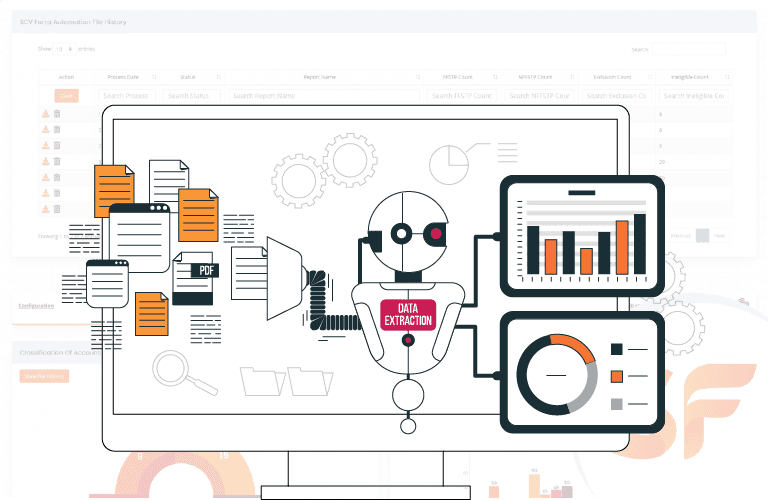

Gain flexibility with our automated FSCS SCV reporting solution SCV Forza, designed for financial institutions to meet regulatory demands efficiently.

Banks

Client Audits from year 2010

Audits

CBS Integration

The best solution to all your challenges around FSCS regulatory reporting

Automate your FSCS SCV reporting with the fully tried and tested 10th Gen Single Customer View platform.

Data Aggregation

Fully automated intelligent platform provides you with the utmost data integration, managing account segregations carefully using linked accounts and related datasets. Generates accurate SCV reports to the satisfaction of FSCS.

Data Quality

Easily integrate with CBS, facilitates multi-level data validations and control procedures using AI-based fuzzy logic, prevents data duplication, and generates accurate SCV reports quickly in the correct format for FSCS submission.

Data Privacy & Compliance

Complies with ISO standards and FSCS regulatory requirements. ensures a high level of data security and compliance throughout the entire regulatory life cycle. Protects your SCV output files with a highly encrypted and complex password mechanism.

FSCS SCV Enterprise Solution Suite generates necessary reports, reduces the compliance risks, and retains “Green Status Adherence” with PRA for

Featuring an automated SCV reporting solution empowers financial institutions to meet FSCS regulatory demands efficiently.

An out-of-the-box SCV reporting solution automates your compliance process and maintains control over evolving regulatory requirements.

platform

- Microsoft SQL Server Integration Services (SSIS) ETL engine delivers high-performance data integration that can handle data up to 50 million records.

- Robust solution which reduces the data-related risks and meets the 24-hour deadline with utmost accuracy.

& Fulfilment

- Integrate with any core banking system or external data sources including legacy platforms or Excel-based data.

- Easily import the required data and identify the individuals and entities to be reported, including exclusion, effectiveness, and completeness reports.

Algorithms & Logics

- Eliminates the potential for human error by associating algorithms, formulae, and logic with predetermined business/process rules.

- Facilitates account/customer rule management, data enrichment and validation.

- Automated reconciliation at any time during the accounting period and a complete audit trail of all previous reconciliations.

Governance Framework

- Fully automated intelligent platform comes with Data mining, Data Cleaning, Data Enrichment and Reconciliation functionalities to help you understand and identify the gap in the current organisational data model with the regulatory expectations.

- Enhances the quality and richness of the data and generates complete, valid, consistent, and accurate SCV reports that enable businesses to automate and streamline data-driven decision-making.

SSIS based ETL platform

- Microsoft SQL Server Integration Services (SSIS) ETL engine delivers high-performance data integration that can handle data up to 50 million records.

- Robust solution which reduces the data-related risks and meets the 24-hour deadline with utmost accuracy.

Data Orchestration & Fulfilment

- Integrate with any core banking system or external data sources including legacy platforms or Excel-based data.

- Easily import the required data and identify the individuals and entities to be reported, including exclusion, effectiveness, and completeness reports.

AI-based Computing Algorithms & Logics

- Eliminates the potential for human error by associating algorithms, formulae, and logic with predetermined business/process rules.

- Facilitates account/customer rule management, data enrichment and validation.

- Automated reconciliation at any time during the accounting period and a complete audit trail of all previous reconciliations.

Defined Data Governance Framework

- Fully automated intelligent platform comes with Data mining, Data Cleaning, Data Enrichment and Reconciliation functionalities to help you understand and identify the gap in the current organisational data model with the regulatory expectations.

- Enhances the quality and richness of the data and generates complete, valid, consistent, and accurate SCV reports that enable businesses to automate and streamline data-driven decision-making.

Transform, automate, and streamline regulatory operations, end to end

Collect & Cleanse

Structure & Enrich

Validate & Transform

Audit & Screening

Communicate & Engage

Save Time and Eliminate Errors with SCV Forza, an Automated FSCS SCV Reporting Platform.

AI-based, fully automated data-driven compliance platform comes with automated calculations and electronic submissions to RegData, guarantees data accuracy and is fully FSCS compliant.

Extensive Audit reports

Data validation reporting to analyse reportable data and highlight any data formatting issues that conflict with the mandatory fields. Our exception reports would greatly support the financial institutions to update the inaccurate information before submission and submit the SCV output file with greater confidence.

Scalable / Future-proof

Periodical Central patch update on FSCS new findings and Rules and audit requirements changes. Quarterly auto update of new audit validations.

SME Consulting

The Business Consulting team offers support on the Governance and operational practices in the FSCS reporting landscape. Assistance to submit required documents as per the FSCS requirements.

We do not spare any effort in ensuring data security and compliance

Our FSCS SCV Enterprise Solution Suite is fully compliant with strict regulations based on recommended industry standards. Flexible and economical architecture ensures strong data protection in a secured Azure Cloud, featuring session-based and secured multi-factor authentication to protect client transmission session data.

Complies with ISO standards

Strong customer authentication

IP restrictions for Admin Portal

Microsoft Enterprise Grade Security

Secure data capture

Stringent data retention policies

Malware Protection

Robust 256-bits Encryption

Periodic VAPT to the webserver

3D Secure authentication

URL copy prevention

SAS, EIT, EAR, NLC, Physical and Web App Level Firewall

Complies with ISO standards

Strong customer authentication

IP restrictions for Admin Portal

Microsoft Enterprise Grade Security

Secure data capture

Stringent data retention policies

256-bit SSL encryption

Malware Protection

Periodic VAPT to the webserver

3D Secure authentication

URL copy prevention

SAS, EIT, EAR, NLC, Physical and Web App Level Firewall

Our Knowledge Base Resources

CASE STUDY

Unlocking Data Accuracy & Security: Macro Global's Key to The UK Bank's SCV Reporting Success

CASE STUDY

Bridging the Data Gap: A Building Society's Journey to Efficient FSCS Reporting

CASE STUDY

Excel to Excellence: Modernising FSCS Regulatory Reporting in Building Societies

WHITEPAPER

Revolutionising FSCS SCV Reporting: Ensuring Data Accuracy and Integrity by Resolving Technology Challenges

WHITEPAPER

Empower Credit Unions with a Data Management Edge: Mastering FSCS SCV Reporting with MG

WHITEPAPER

FSCS Regulatory Reporting on Cloud: Cloud Adoption of FIs

BUSINESS CASE

Macro Global's SCV Approach and Implementation

BUSINESS CASE

Reconciliation support with CBS Data Reporting

BUSINESS CASE

Data Augmentation with Data Enrichment Process

FAQs

What Is FSCS Protection?

The Financial Services Compensation Scheme (FSCS) is a UK government-backed protection mechanism that covers customers of financial institutions that are insolvent.

Key points regarding FSCS protection:

- Government-backed

- Safeguards deposits, investments and general insurance plans with no upper limit are already protected by FSCS.

- There are restrictions on the amount of compensation that can be sought.

Who Is Covered by the FSCS?

The Financial Services Compensation Scheme (FSCS) covers the following entities and the individuals who fall under these groups:

- Banks

- Building societies

- Credit unions

- Debt management firms

- Funeral plan providers

- Insurance companies

- Insurance brokers or financial advisors

- Investment firms

- Mortgage providers

- Payment protection insurance (PPI) providers

- Pensions providers

- Mutual Societies and Friendly Societies

It’s important to note that eligibility for compensation under FSCS is subject to meeting specific criteria and limits set by the UK regulators, the Financial Conduct Authority, and the Prudential Regulation Authority.

FSCS excludes certain entities, such as investments in peer-to-peer lending, smaller financial products such as pre-paid currency cards and financial services from PayPal, credit unions not authorised by the PRA and the FCA, and investments in non-UK-registered firms. Additionally, FSCS does not cover claims for poor investment performance, company failure due to market forces or poor business decisions, or claims for inconvenience, distress, or disappointment.

To know extensively who are eligible under FSCS protection, click this link:

https://www.fscs.org.uk/check/ and get informed.

When Do the Deposit Takers Submit an SCV File?

Deposit takers must submit a SCV file to the PRA or the FSCS within 24 hours of a deposit takers failure or at the request of the PRA or the FSCS. The 24-hour timeline applies on weekends and public holidays. It is critical for determining potential compensation obligations in the event of insolvency.

What Is FSCS SCV Effective Reporting?

FSCS SCV Effectiveness Report is a report that firms must submit to the FSCS or Prudential Regulation Authority (PRA) upon request.

The report must include information about the firm’s SCV system, how it is implemented, and any keys or code utilised internally.

This information helps the FSCS evaluate the firm’s systems and processes and identify areas for reform.

Firms must also update their SCV effectiveness report annually, including a statement about any major system modifications from the preceding report.

What Is Exclusion File In SCV?

The Exclusion file is a crucial component of the Single Customer View (SCV), which includes customer and depositor information, associated accounts and deposits. The Exclusion file specifies the sort of exclusion from the SCV file, including legally disputed, legally dormant, sanctioned, and beneficiary accounts.

What Is the Reporting Format for Submitting the SCV Exclusion File?

Three SCV Formats:

Format 1: Separate files for each table: customer details, contact info, account details, and aggregate balance details.

Format 2: Two separate files: first contains customer, contact, and aggregate balance details, second accounts details.

Format 3: Combines all four tables into a single file.

What Types of Files Are Accepted by FSCS In Reporting?

The FSCS accepts three file types: Excel (.xlsx), XML (.xml), and Text (.txt or.csv).

How Are the Accounts Excluded Under the SCV Exclusion File?

The excluded accounts typically fall into the following categories:

- Sanctioned accounts: Accounts associated with individuals or entities on a sanctions list.

- Legally disputed accounts: Accounts with formal notices of conflicting claims or legal disputes.

- Legally dormant accounts: Accounts with no depositor-initiated transactions for a specified period.

- Beneficiary accounts: Accounts held on behalf of or for the benefit of another person.

What Currency Denomination Is Offered on Submitting FSCS SCV Reporting?

Compensation from FSCS is paid out in Pound Sterling. The SCV should display the Pound Sterling equivalent of foreign currency balances, as well as the corresponding exchange rates. The Exchange Rate in the SCV and Exclusions View files should be current as of the date demanded by FSCS or the PRA. In general, the spot rate set by the Bank of England is recommended.

Banks & financial institutions across the world are building their digital transformation journey through our platforms

Still not convinced? Hear what our clients say

IT Manager, Bank Sepah International plc

London

We have been working with Macro Global for good 7+ years and the team is unique with their approach and hold their patience with limitless iteration to resolve the problem by engaging great attention to detail on root cause analysis. We can rely on them in almost on all critical priorities and their support is second to none. Great bunch of professionals and we look forward working with them for the foreseeable future.

Risk Governance Manager, Riyad Bank

London

RBL has worked with Macro Global for over three years. We find their service to be first class. The team are exceptionally helpful and professional. In our opinion we couldn’t ask for a better business provider and would recommend Macro Global to all concerned.

Head of Compliance, Bank of India U.K. Operations

London

Pleased with the timely delivery, excellent service standards, easy accessibility and professional approach of the Macro global team. From our business experience of the past 5 years, we can say it is a reliable, growing outsourcing firm excelling in execution, customer support and delivery commitments, and helping us to meet the regulatory reporting targets.

Head of Operations, IT & Facilities, ICICI Bank UK Plc

London

I feel that the team at Macro Global is amongst one of the best I have ever interacted with in my career. Their expertise in the subject matter, understanding and documentation of processes, detailing of every step of the project and ability to deliver on regulatory reporting (SCV & CRS) and technology platforms (PSD2) amid tight timelines is commendable. This coupled with an visionary leader – Saro, guiding them is a sure-shot recipe for success. I wish them best of luck and am sure they will grow to even greater heights!

Head of Compliance, Bank of India U.K. Operations

London

Pleased with the timely delivery, excellent service standards, easy accessibility and professional approach of the Macro global team. From our business experience of the past 5 years, we can say it is a reliable, growing outsourcing firm excelling in execution, customer support and delivery commitments, and helping us to meet the regulatory reporting targets.

Risk Governance Manager, Riyad Bank

London

RBL has worked with Macro Global for over three years. We find their service to be first class. The team are exceptionally helpful and professional. In our opinion we couldn’t ask for a better business provider and would recommend Macro Global to all concerned.

Head of Operations, IT & Facilities, ICICI Bank UK Plc

London

I feel that the team at Macro Global is amongst one of the best I have ever interacted with in my career. Their expertise in the subject matter, understanding and documentation of processes, detailing of every step of the project and ability to deliver on regulatory reporting (SCV & CRS) and technology platforms (PSD2) amid tight timelines is commendable. This coupled with an visionary leader – Saro, guiding them is a sure-shot recipe for success. I wish them best of luck and am sure they will grow to even greater heights!

IT Manager, Bank Sepah International plc

London

We have been working with Macro Global for good 7+ years and the team is unique with their approach and hold their patience with limitless iteration to resolve the problem by engaging great attention to detail on root cause analysis. We can rely on them in almost on all critical priorities and their support is second to none. Great bunch of professionals and we look forward working with them for the foreseeable future.